Using carbon farming to improve smallholder farmers’ climate resilience

Insuring smallholder farmers remains a challenge, despite significant efforts to promote various agricultural insurance services. Many agricultural insurance schemes have simply struggled to scale after launching successful pilot schemes. Globally, just over eight million smallholder farmers are estimated to have cover – a penetration rate of under 3%. Several factors have contributed to this gap, two of which stand out: most farmers struggle to afford insurance premiums, and – as a result – most insurers are reluctant to offer products for smallholders. In Sub-Saharan Africa, the affordability gap is particularly wide: around 97% of smallholder farmers in Africa are unable to afford insurance because of low earnings.

Etherisc plans to tackle these problems in a unique way. The company uses blockchain technology to improve the efficiency of buying and selling insurance policies, through lower operational costs and better transparency. Etherisc has developed a platform allowing anyone to create insurance products that is based on a common infrastructure, product templates and insurance platform-as-a-service.

The platform is being used in a few instances to educate farmers on carbon farming and help them sell the carbon offsets. After an initial pilot with Aon, Sanasa Insurance and Oxfam in Sri Lanka, the company then deployed the platform in Kenya to reduce costs and improve processes for ACRE Africa, an agricultural insurance technical service provider. Other initiatives using the platform include the Lemonade Crypto Climate Coalition in Kenya and an initiative involving the WFP, Yelen Assurance and African Risk Capacity Ltd in Burkina Faso. Despite this progress, the experience has so far highlighted that insurance can still be unaffordable for many smallholder farmers.

Globally, smallholder farmers will continue to remain exposed to the impacts of climate change. While many high-income and a few middle-income countries are making their agricultural sectors more “climate-smart”, smallholder farmers in low- and middle-income countries risk being left behind. This can be changed. Beyond using technology to deliver insurance to smallholders, Etherisc has embarked on an initiative to encourage millions of smallholder farmers to adopt climate-smart agricultural practices. They aim to do this by combining carbon markets with insurance and blockchain technology.

Etherisc has developed an innovative scheme through which farmers can become more climate-resilient and simultaneously generate additional income. Smallholders would be encouraged to practise agroforestry or increase their use of biochar, a natural charcoal that is created when organic materials, such as wood and agricultural by-products, decompose under the presence of heat. It can reduce atmospheric carbon dioxide levels by stabilising carbon in a biologically unavailable form, sequestering it out of the atmosphere and into the soil for hundreds of years.

The scheme then relies on satellite technology to track, measure, and remotely verify such sequestered carbon dioxide, and eventually certify it as carbon offset certificates. These certificates can be sold on carbon markets, through which participating farmers would receive a share of sales revenues. Part of these funds could be deducted to pay for agricultural insurance premiums. Etherisc’s platform has the ability to manage and track the end-to-end transactions this scheme would involve.

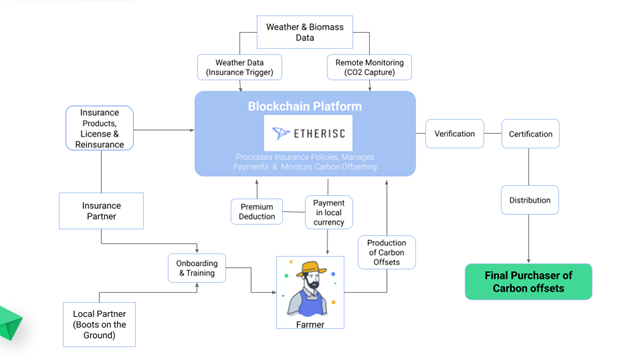

So how would this work in practice? Several actors would have roles to play (Figure 1):

- Farmers would be participants in the carbon farming programme.

- Carbon credit buyers would be offered a way to offset carbon while being involved in an initiative to improve the lives of climate-affected farmers.

- Local partners would be needed to run livelihood and financial inclusion programmes for smallholder farmers and oversee ground-level activities (such as onboarding, capacity building and monitoring).

- Etherisc would be responsible for designing and developing the smart contracts-based platform. As a single source of reference, the platform would:

- Automatically transfer revenues to farmers and deduct premiums for insurance;

- Distribute the insurance product automatically and manage related pay-outs;

- Streamline farmer onboarding, monitoring and performance reporting;

- Make revenue and remuneration payments to all parties; and

- Serve as a real-time dashboard for all participating stakeholders to monitor.

Figure 1: Etherisc’s carbon farming programme

| “If 97% of smallholder farmers can’t afford insurance, then smallholder farmers simply don’t earn enough. Yet, the price of climate risk is increasing. We can’t reverse that, but what we can do is connect farmers to the carbon markets, where increasing numbers of large corporations are looking for high-quality carbon offsets to meet their net-zero targets.” Jan Stockhausen, Chief Legal Architect of Etherisc and Director of Etherisc Impact B.V. |

So far, Etherisc has identified partners for some of its first use cases. Several projects are already targeting smallholder farmers for a specific approach to carbon farming based on the crop they plant, with particular crops prioritised by country. For instance, rice farmers in Ghana have been targeted by UNDP with alternate wetting and drying irrigation, while other organisations target cocoa farmers in Côte d’Ivoire and coffee farmers in Colombia with agroforestry. In Kenya, biochar strategies have been implemented across farmers playing several types of crops.

With various parts of the world seeing extreme weather conditions occur regularly, the cost of insuring risks that smallholder farmers face is likely to increase and may remain high. This scheme has the potential to overcome the affordability barrier that millions of smallholder farmers face worldwide. By reducing farmers’ price sensitivity, more insurance providers may be compelled to offer agricultural insurance products too. While early pilots are ongoing, additional partnerships are required to bring funding and distribution potential to enable the scheme to scale and succeed.