The 2024 Landscape of Microinsurance: Busting myths on microinsurance

In March 2025, the 2024 Landscape of Microinsurance was launched by the Microinsurance Network. Seen as the annual state of the health and wealth of the industry, the report shows how microinsurance uptake continues to evolve every year (Figure 1). Early insights from the report were revealed at the International Conference on Inclusive Insurance 2024 in Kathmandu, Nepal. There, yet-to-be-released data from the 2024 report were used to counter six myths on microinsurance:

- There are limited business opportunities and scalability in microinsurance,

- There is not enough information to grow microinsurance services,

- Microinsurance struggles to drive financial inclusion,

- Reaching the target population is very challenging,

- Regulation is a major constraint for further development; and

- Some risks are simply uninsurable or unaffordable.

Figure 1: A snapshot of the microinsurance industry, 2023

344 m People covered by microinsurance in 2023 (up from 331 m in 2022) |

37 countries Surveyed in the 2024 Landscape (up from 36 in 2023) |

$6.2 bn Gross written premiums in 2023 (up from $5.8 bn in 2022) |

985 products Offered by providers in 294 countries (down from 1,042 in 2023) |

Source: Microinsurance Network, (2025). The 2024 Landscape of Microinsurance.

Myth 1: Microinsurance offers limited opportunities to scale

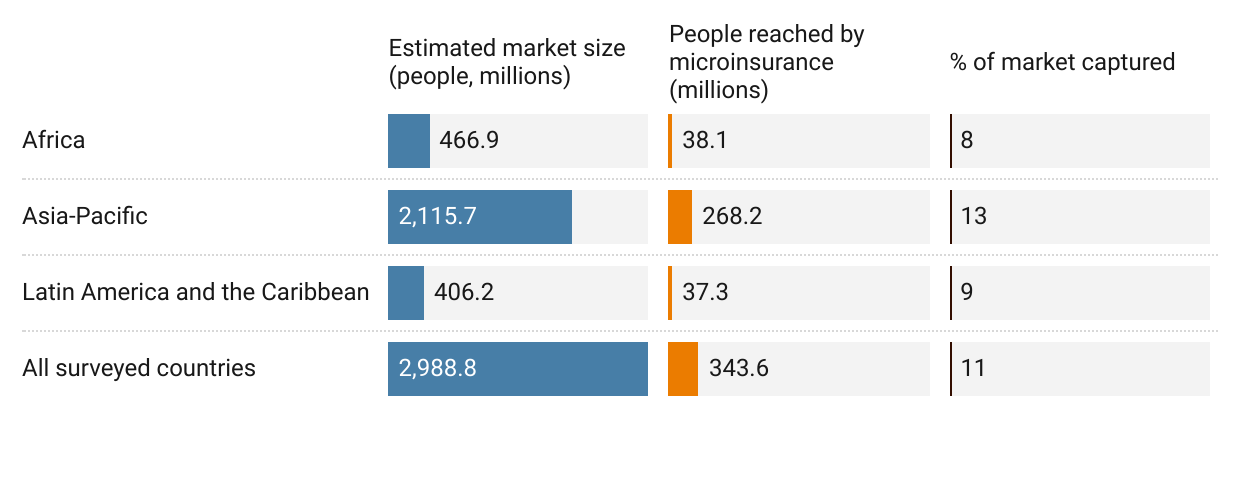

Microinsurance is generally seen as difficult to scale and offers limited profitability potential. This has prevented many insurers from entering the microinsurance space. Despite this, the number of people covered by microinsurance providers grew to around 344 million in 2023 – up from 294 million in 2022. The majority of these customers, nearly 80%, are in the Asia-Pacific region (Figure 2). Overall, only 11% of the total microinsurance market has been captured. There remains a significant opportunity to scale services in Africa, Asia-Pacific and Latin America.

Figure 2: Microinsurance penetration by region, 2023

Source: Microinsurance Network, (2025). The 2024 Landscape of Microinsurance.

Microinsurance relies on affordable, low-value premiums, which makes achieving high volumes critical for long-term commercial viability. As of 2024, the median number of customers per microinsurance product exceeded 10,000, generating nearly $120,000 in annual premiums per product. Certain product types, such as credit life and funeral insurance, reach even wider coverage—serving approximately 29,000 individuals per product. Most products require three to four years to scale, but beyond this point, they can typically generate close to $500,000 in annual premiums. Sustained growth is attainable through patient investment and strategic, long-term planning.

Myth 2: There’s insufficient information to grow microinsurance services

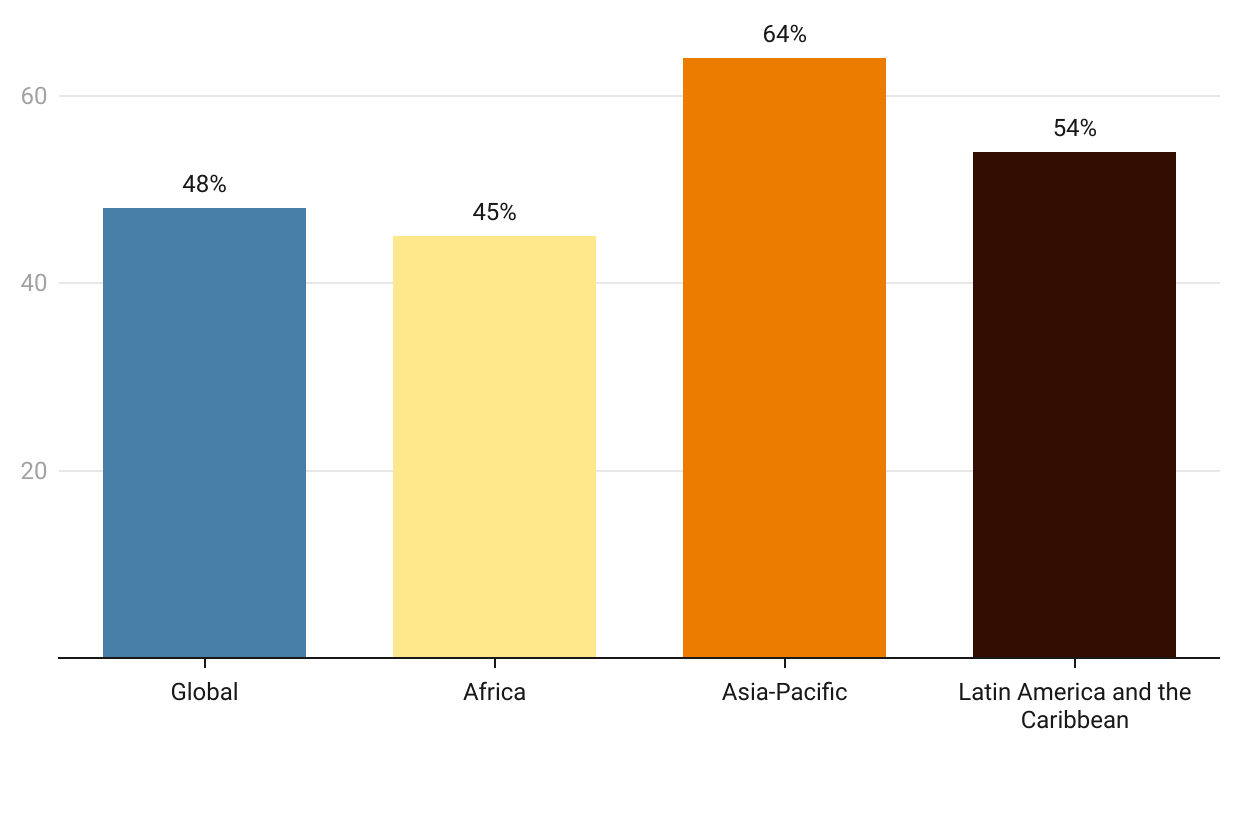

The gender gap in microinsurance is as prevailing an issue as it is more broadly in financial inclusion. Part of this gap not narrowing quickly enough can be attributed to a lack of information on the demand and uptake of microinsurance among women customers. While this remains an industry concern, improvements in reporting are leading to more reliable gender-disaggregated data. In 2023, around 48% of policyholders were women (Figure 3); around 49% of all people covered by microinsurance were women.

Figure 3: Median percentage of female microinsurance policyholders by region, 2023

Source: Morales, N. (2024) Presentation on the “The Landscape of Microinsurance: Bridging gaps, building futures” at ICII 2024.

Improving data collection, particularly on gender, is an objective for several insurance providers and regulators. To aid the latter, A2ii has launched its FeMa-Meter tool in 2024. The tool is designed to highlight the differences across various indicators between men and women. This is one of several examples of how the microinsurance space is collecting more data or simply has access to hitherto unavailable information. Related to this, the industry faces a new challenge: how can it remain prepared and able to use this emerging wealth of data constructively?

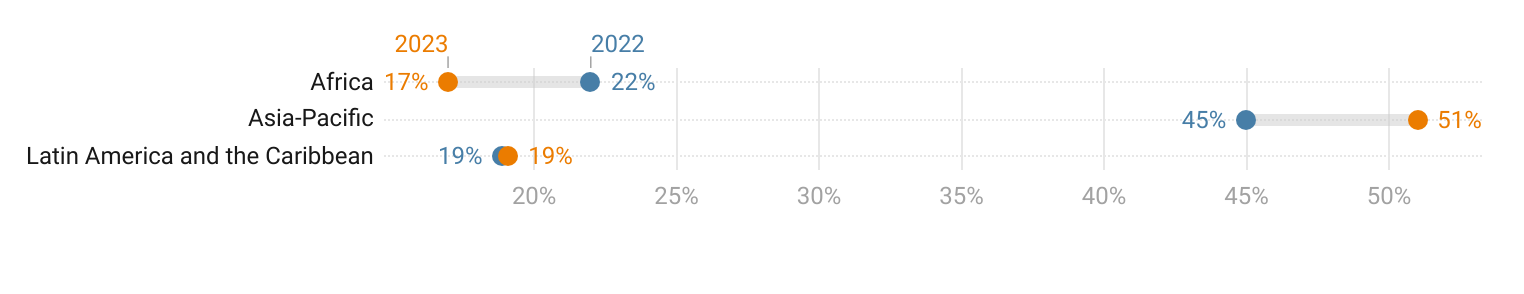

Myth 3: Microinsurance struggles to contribute to financial inclusion growth

There is often less attention paid to microinsurance’s ability to drive access to particular payment channels. Data from both the 2023 and 2024 Landscape of Microinsurance shows that cash use varies across the three main regions (Figure 4). In Africa, the number of products that rely on cash payments has declined from 22% in 2022 to 17% in 2023. The growth of digital payments in Africa has seen around 15% of microinsurance products use mobile money, up from 12% in 2022. However, the decline in cash is not a uniform trend: in Asia, cash use rose in 2023.

Figure 4: The use of cash payments in microinsurance, 2022 vs 2023

Source: Microinsurance Network calculations

Differences in penetration levels by region tend to affect how each payment channel is used for microinsurance payments. Yet, this is also tied closely to how products are distributed to target customers. In some markets, such as Kenya, microinsurance has prompted users to adopt payment methods other than cash – high mobile penetration rates have led to some customers opening mobile money accounts to access microinsurance services. However, microinsurance still relies on digital financial services to provide the rails for further expansion in the future.

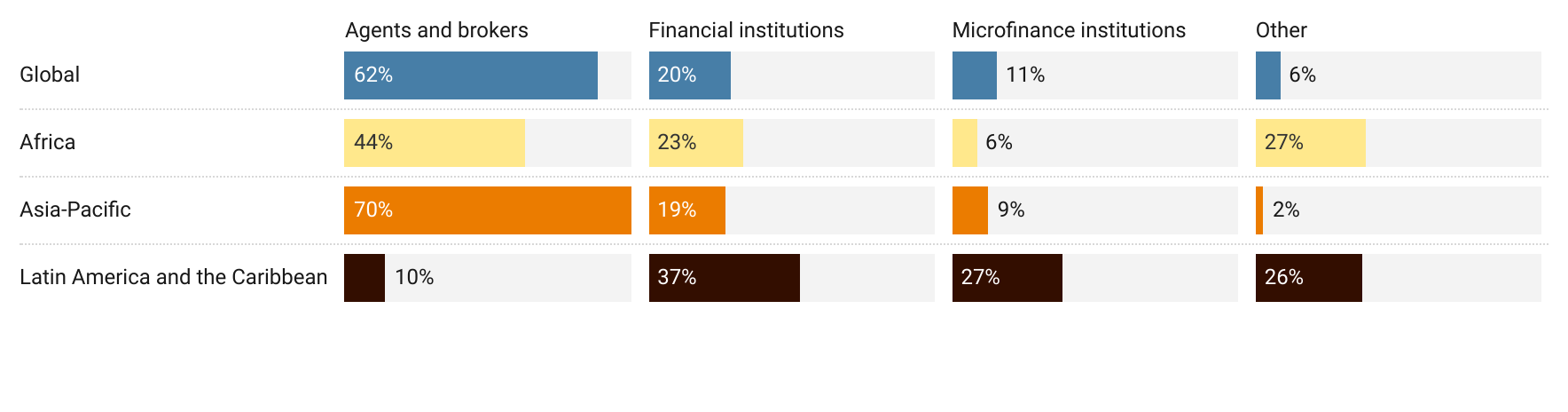

Myth 4: Distributing microinsurance products is a significant challenge

Reaching the target is a key challenge for most microinsurance providers. Distribution is typically seen as the main barrier to scaling products and services worldwide. Data from the 2024 Landscape shows that providers are using a range of distribution channels to reach their target markets (Figure 5). Agents and brokers are the main channels in Africa and Asia-Pacific. Latin America and the Caribbean has a more fragmented distribution landscape, with financial institutions slightly more likely to be used over other channels.

Figure 5: Percentage of microinsurance users covered by distribution channel, 2023

Source: Morales, N. (2024) Presentation on “The Landscape of Microinsurance: Bridging gaps, building futures” at ICII 2024.

Notes: Other includes credit unions, employers and digital providers.

While traditional channels remain essential to reach a growing number of users, new partnerships with a range of aggregators may help to drive microinsurance’s future growth. Some of these new partners include schools, government networks, public service companies and mass-market distributors. In addition, the emergence of insurtechs – though limited in microinsurance – suggests that the use of technology may become more commonplace. For example, as artificial intelligence becomes more widely available and affordable, its application in microinsurance stands to grow.

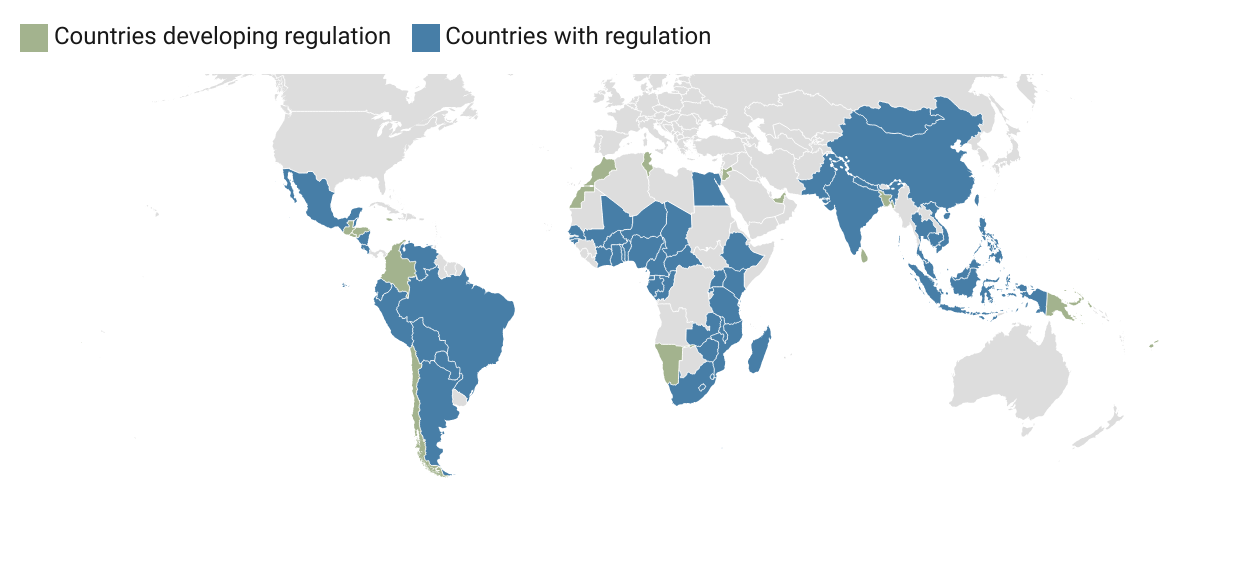

Myth 5: Regulation inhibits the development of microinsurance

Insurance regulations are a key ingredient for microinsurance services to develop and grow. As a result, regulators are seen as industry enablers. The number of countries with specific regulations on microinsurance (or inclusive insurance) has continued to grow over time. As of 2024, at least 40 regulators across 53 countries and territories had launched enabling microinsurance regulations (Figure 6). At the same time, regulators in 16 markets were in the process of developing regulations for microinsurance services to develop further.

Figure 6: Microinsurance regulatory status by country, 2024

Source: Microinsurance Network, (2025). The 2024 Landscape of Microinsurance.

Note: The CIMA region comprises 14 countries in Central and West Africa under a single set of microinsurance regulations.

Myth 6: Some risks are too expensive to insure

For the first time, the 2024 Landscape included data on subsidies provided by governments and donors. Subsidies allow low-income communities to access insurance and protect themselves against different types of risks by making microinsurance products affordable. This is certainly the case for agriculture insurance, where around 58% of products are subsidised to some extent. Subsidies were also found to catalyse the development and growth of other products, such as property and income insurance. To be effective, subsidies need to be implemented responsibly and transparently, with a strategy for contributions by policyholders in the long term.

While the 2024 Landscape of Microinsurance highlights significant growth in the industry, there remains a huge protection gap. This highlights a significant opportunity for insurance providers to pursue. The estimated market for microinsurance is around 3 billion people in the countries surveyed for the report – worth around $41 billion in premiums. With only 12% of these individuals currently covered, microinsurance providers face a sizable business opportunity.

Click here to read The Landscape of Microinsurance 2024.