The FeMa-Meter tool: Why data is necessary to close the gender gap

Many inclusive insurance products are gender-neutral and can neglect women’s specific needs. Developing products for women is often hindered by a lack of data. Data on gender can help insurers and policymakers understand different market needs. Sex-disaggregated data can lead to targeted policies, more accurate risk assessments and products better suited to different customer segments.

However, perceived limited value by insurers and varying collecting methods have impacted policies and decision-making processes – particularly for regulators. Regulators can significantly improve women’s access to insurance and gender inclusivity through better data. For many regulators, improving the collection of sex-disaggregated data is a priority. The use of technology has played an important role in bridging some of the existing data gaps. Other initiatives have also been launched to enable better data collection.

Introducing the FeMa-Meter tool

A2ii has developed several tools, such as the FeMa-Meter, to support this process. The FeMa-Meter is a Microsoft Excel-based tool that collects sex-disaggregated data on 13 key indicators across market access, usage and governance. The tool uses input data to provide immediate and simple calculations on the differences across various indicators between men and women. It is designed to be used by insurance providers, regulators, supervisors and policymakers.

The FeMa-Meter was developed in 2022 by A2ii with support from the Swiss Agency for Development Co-operation (SDC). This initiative was part of a larger project, “Empowering supervisors to improve women’s access to insurance”. Through this, A2ii identified the need to collect more data, based on demand for information on the underinsured. After its creation, the tool was piloted in several markets before a full launch in March 2024.

Early pilot results have helped to identify gaps

During the pilot, several feedback sessions were run with insurers and supervisors to understand their experience. While the tool is clear and easy to use, some supervisors needed clarity on fitting various products – such as bundled services – into the tool’s predetermined categories. Through this, it became apparent that the tool’s strength lies in its ability to present two different outcomes: highlighting gaps where data is unreliable and displaying complete datasets where available. Where there are big gaps, the tool can indicate this as “unreliable data” and not generate the expected graphs. This led some users to believe that the tool was not functioning properly.

Based on these outcomes, detailed changes were made to ensure that the tool was technically sound. This included additional work on narrowing down some of the data categories. The pilot phase aimed to ensure that the tool would work for the companies trialling it – there was a lower emphasis on the early results. The lack of data was considered an important success marker at this stage. New users are likely to be encouraged to use the tool to identify as many data gaps as they can, rather than expect a complete dataset to emerge.

Why regulators are important enablers in collecting sex-disaggregated data

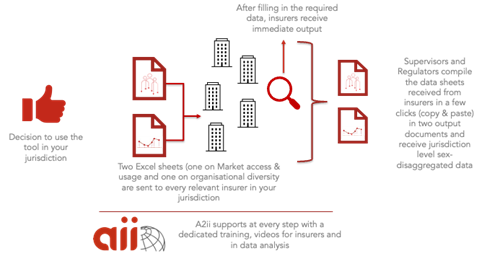

The tool was inspired by A2ii’s focus on diversity, equity, and inclusion (DEI) and aims to provide data for regulatory action and organisational improvements. Determining how women are treated by regulatory authorities is a priority (and DEI) mandate for the International Association of Insurance Supervisors (IAIS) too. The FeMa-Meter tool aims to look at improving both the regulatory focus and the organisational side of insurance (Figure 1).

Figure 1: How the FeMa-Meter tool is set up to work

Policy efforts in inclusive insurance have yet to achieve the desired impact, particularly in narrowing the gender gap and improving women’s participation. To drive progress, collecting data on gender disparities is important. Regulators can use the tool to collect data that can be used to support policy advocacy and make informed decisions on gender dynamics in their markets. The best-case outcome would see regulators adopting the tool in their markets and eventually mandating its use for insurer reporting.

The ideal scenario is a top-down approach from regulators

Organisations looking to use the FeMa-Meter tool can download it from A2ii’s website and use it to collect data. In their first year of use, reporting organisations may not be able to provide all the data. However, this means that data gaps can be easily highlighted. By the third year of use, it may be possible to have a more complete data set. The ideal scenario would involve the regulator owning the reporting process and ensuring that all insurers are on board with the approach.

Efforts are underway to explore how the tool's indicators could be integrated into standard reporting requirements and regulatory technologies. However, early discussions and initial use have suggested that while some companies can provide the requested data, others face challenges due to internal data limitations. Example limitations include gaps in sex-disaggregated data. For some organisations, adopting the tool could be a gradual learning process.

The tool has achieved some success among early adopters

A2ii’s approach is to work together with regional organisations as a means to target their members for a particular initiative. This has yielded success in the past. Through this, A2ii has had some success in promoting the use of the FeMa-Meter tool in Latin America, among members of Asociación de Supervisores de Seguros de América Latina (ASSAL). Among ASSAL’s members, Guatemala and Puerto Rico are among the first countries and territories in the region to finish using the tool. Elsewhere, in Asia, Nepal has been running the FeMa-Meter tool too.

The first results from Guatemala and Costa Rica are now available. Data from these markets will be used to inform insurance companies, regulators and supervisors where there might be challenges in collecting data. Regulators in both countries are keen to discuss the results and possible next steps, ideally to bridge the gap between data and action.

As part of the next steps for the tool, insurance companies, as well as regulators and supervisors in other markets are planning to collect data using the FeMa-Meter. Additional targeting may continue later in 2025, with regional coordinators being relied on to deploy the tool among regional organisations and their members. For A2ii, the ultimate aim is for the FeMA-Meter to become a standalone tool that insurance companies and regulators can use on a self-service and on-demand basis. And while A2ii uses a top-down approach, the aim is for all organisations in the insurance value chain to benefit from the tool.