2022 Landscape Study: Highlighting growth and opportunity in the inclusive insurance market

Around 68% of the world’s population are emerging consumers - that is those living on between Int $2 – Int $20 per day. This is the target consumer group for microinsurance products and yet, according to the Microinsurance Network’s recently released 2022 Landscape Study, only 8% are covered by insurance outside of any public social security system.

This presents a massive opportunity for the inclusive insurance sector. Many of these people live in increasingly vulnerable economic and social situations as the impacts of climate change are seen more widely. As a result, the role of inclusive insurance is likely to become even more critical over the coming years.

This year’s Landscape Study reports responses from 253 insurance providers across 935 products in 34 countries. The conclusions of the study show that while the industry has almost recovered to pre-pandemic levels and is moving forward, there is still room for improvement to ensure more of the market can be captured. For example, much more can be done to improve women’s access to microinsurance products and services; as in previous years, very limited gender-oriented data was reported and if this continues, the industry will struggle to meet the specific needs of women. In addition to this known challenge, new ones are also emerging. While the growth of digital platforms has made insurance accessible to more people, it has also highlighted emerging risks of identity theft, cybersecurity and a growing cyber protection gap.

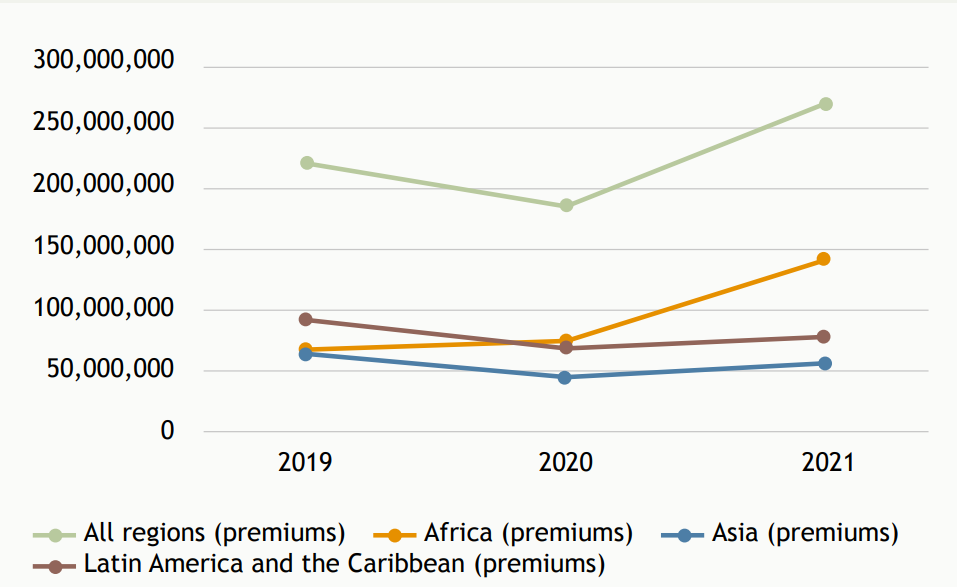

There is still much to celebrate though. The microinsurance industry has seen a recovery after setbacks caused by COVID-19. Based on data from products that have been reported every year for the last three years, customer numbers have almost recovered to 2019 levels. When looking at all reported products in 2021, total premiums collected doubled from USD 1.1 billion in 2020 to USD 2.2 billion in 2021. This is due to product variety, economic recovery and the associated increase in customers’ spending power. Additionally, a growing number of countries are adopting microinsurance guidelines and recommendations which highlights how perceptions of microinsurance and its potential impact on economic stability are changing.

Evolution in premiums collected (USD) from 2019 to 2021

Exposure to climate risk is becoming mainstream

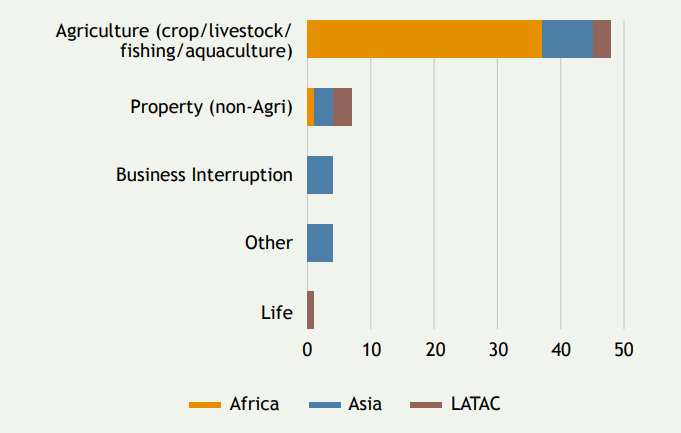

Microinsurance’s role in helping to alleviate some of the challenges caused by climate change is also apparent in this year’s study. In 2021, 13.3 million people were covered through 64 products which included some coverage for climate risks. While the majority (48) were agriculture products, climate covers were also included in property, business interruption and life products.

This shows that climate-related microinsurance is now going beyond its traditional sphere of agriculture as it becomes clear that the impacts of climate change are being felt more widely by society, including those in urban areas. For example, it is known that climate and health risks are interrelated. In September 2021, a joint declaration from more than 200 medical journals recognised climate change as the “greatest threat to global public health.” Property and climate risks are also closely linked, as homes and businesses can be damaged or destroyed due to storms, flooding or wildfires, and economic stability can be impacted if businesses cannot operate during extreme weather events.

Products including climate cover

As climate risk increases, some novel ways of tackling the problem through insurance are emerging. For example, in the Philippines - which has the highest disaster risk globally - the insurance sector does not have the financial capacity to handle climate disaster risk, and this has contributed to low penetration in the country. In 2018, it was estimated that the annual expected loss from natural catastrophes would exceed USD 1.1 billion - more than 70% of the industry’s net worth. To address this, the Philippines Insurance Commission set up the Philippine Catastrophe Insurance Facility (PCIF) through which companies can pool risks with other participating companies, allowing them to cover larger risks than they could alone and manage their catastrophe exposures more effectively. Through this mechanism, the facility is expected to reach a capacity of USD 25.5 million.

Successful approaches to reaching scale

Despite the increased risk for people in regions affected by climate change, the microinsurance sector is still only reaching a small proportion of this market. For it to be successful long term, it needs to scale. This year’s Landscape Study has shown that offering more diverse and specialised products, particularly in mature markets, can attract customers by adding more value. For example, in the health sector, insurers are exploring higher value disease-specific coverages, such as cover for vector-borne diseases or cancer. In 2021, these types of cover reached approximately 4 million people.

Increasingly, health covers are being bundled into other products. Out of 474 products reported that primarily cover death and disability, 83 included secondary health covers such as hospital cash, medical expenses or emergency cover. In total, 53 million people received some health protection as a secondary cover through products in other product lines. This was also seen across other products. For example, life and accident risks were covered as secondary risks by 46 products in other product lines, including property, health, agriculture, motor and transport insurance.

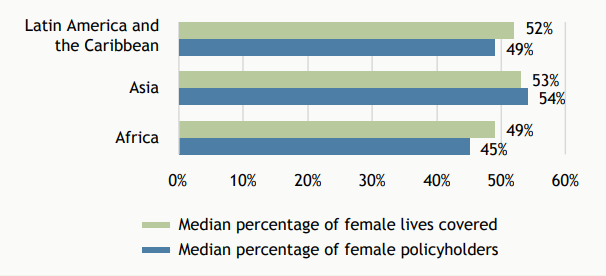

Providing coverage that targets women specifically is another way companies can scale. The limited gender-aggregated data provided to the 2022 study shows that while a median of 50% of people covered by microinsurance products were women, they only made up a median of 49% of policyholders. Yet, if insurance companies target women specifically, they can unlock their decision-making power in selecting and managing their insurance protection, as women have different needs to men.

Median percentage of female policyholders and female lives covered

Microinsurance companies are also looking to scale and remain competitive by diversifying distribution channels. Digital platforms have been an emerging trend over recent years and in 2021, it was reported that 38% of products globally used them as at least one distribution strategy. There can be challenges to overcome with this type of channel, particularly around the trust gap with customers, but this gives delivery platforms a stronger incentive to engage with insurers. By working together, they can become more successful.

Designing human-centred products

Real success, though, is more likely to be achieved through human-centred design. By creating products with consumers’ needs in mind, insurance companies can provide a service that is relevant and people will actually use. An obvious example of this is the use of index-based insurance, particularly for climate risk, and regulators are making efforts to ensure that it is included within insurance regulation. Between 2020 and 2021, five out of eight new agriculture products launched were index-based, highlighting the popularity of this type of insurance.

Opportunities within the female insurance market can also be realised by developing products that meet the needs of women. In Guatemala, Aseguradora Confío works closely with distribution channels to continuously develop their voluntary life and health microinsurance product based on the needs of its largely female customer base. In addition to offering attractive health benefits for women, they also worked with partners to adapt their appointment scheduling system, making it easier for customers to confirm appointments. Thanks to this positive experience, customers are encouraging others to sign up and the product is growing at a rate of 5% per month.

Understanding how customers want to access insurance is also crucial to ensuring the uptake of inclusive insurance. In the Philippines, Pioneer identified an opportunity to partner with motorcycle distributors to provide insurance coverage for those purchasing motorcycles. Pioneer works with each distributor to put together a bundle of covers – including damage, accidents and third-party liability - based on the specific needs of its customers, and their ability to pay. The product was launched in 2014 and by 2022 had reached over 400,000 customers through more than 20 partners.

Finally, building trust with consumers is also vital. Research by EFU Life in Pakistan showed that low trust around claim payments was a key constraint for people taking out insurance. As a result, they started a ‘claims campaign’ in which they actively encouraged customers and beneficiaries to make a claim when eligible. The campaign resulted in a 25% increase in its claims for inclusive insurance products in 2021 and paid out over 9000 claims for inclusive insurance products. Payment of claims is a key part of their strategy to build trust and to ensure long term, sustainable growth.

The 2022 Landscape Study shows there is much to be positive about regarding the inclusive insurance industry. Post-pandemic recovery continues; coverage is increasing (when considering products reported over all three previous years); and new, human-centred microinsurance products continue to be launched. Additionally, many insurance companies are successfully incorporating innovative methods to distribute insurance. Despite this, only 7% of the microinsurance market’s value (estimated at USD 30.9 billion) has been captured. Expanding inclusive insurance access not only benefits the most vulnerable in society who are facing increased climate risk, but it also presents an important business opportunity.