What goes “bump” in the night?

It is a truth universally acknowledged, that no one wakes up in the morning wanting to buy insurance. But, as revealed by the latest edition of Global Findex, we are surprisingly consistent when it comes to what keeps us awake at night.

For the first time, Global Findex was able to provide insights into financial worrying and financial resilience. You are strongly encouraged to read these sections in full in the main report and, of course, delve into the data itself. Meanwhile, here are a few key takeaways to whet your appetite.

Financial worrying

The poorer people are, the less likely they are to have an income buffer, adequate savings or access to credit. They are also more likely to worry about money. The survey’s findings validated these very reasonable assumptions, also testing which, out of four common concerns, are most likely to cause financial anxiety.

Ask yourself the same question: do you worry more about:

- What you will live on when you’re too old to work

- How you will pay medical expenses if you or someone in your family has a serious illness or accident

- How you can cover monthly bills and expenses

- How you can cover school or education fees – whether they are your own or those of your dependents

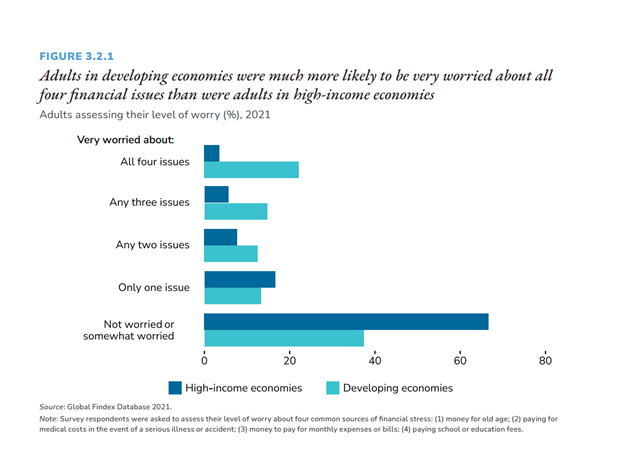

If you live in a developed economy, the chances are that you enjoy better social protection than you do if you live in the developing world. That’s probably why only one in five adults said they worry about any of the four issues, compared to two-thirds of people living in developing countries (see Figure 3.2.1 below - Cf. p. 146 from the Global Findex Report below). It’s true that, having just been through a pandemic, medical expenses could be expected to be front and foremost in people’s minds.

Source: Demirgüç-Kunt, Asli, Leora Klapper, Dorothe Singer, and Saniya Ansar. 2022. The Global Findex Database 2021: Financial Inclusion, Digital Payments, and Resilience in the Age of COVID-19 (p. 146). Washington, DC: World Bank. doi:10.1596/978-1-4648-1897-4. License: Creative Commons Attribution CC BY 3.0 IGO

But, given that even before the pandemic, more than a third of medical costs in low- and middle-income countries were paid for out-of-pocket, this is not “just” about our recent crisis. Indeed, Global Findex found that slightly more than half of adults (52%) in developing economies cited medical expenses as their biggest financial worry. Splitting that into regions, it was the biggest concern for nearly two-thirds (64%) of adults in Sub-Saharan Africa and South Asia, with significant variation in East Asia, depending on the income-level of the country. Here’s the split for East Asia:

- Upper-middle-income economies (e.g. China, Malaysia, Thailand): fewer than 40% of adults are worried about medical expenses

- Lower-middle-income economies (e.g. Cambodia, Indonesia, Philippines): nearly two in three adults worry about this

- Low-income economies: more than 70%

The next deepest concern for people living in Sub-Saharan Africa is how to pay for education: more than half (54%) of adults worry about school fees, and 29% of them cited this as the main source of financial anxiety. Here’s an extract from the report (Cf. p. 165):

“In part, this finding reflects demographics: 52 percent of the population in the region is below the age of 25, and so a large share of the population has school-age children. The financial stress around education may also reflect the high out-of-pocket spending on school fees common in the region. Even families that use public schools are required to pay fees for uniforms and books in many Sub-Saharan African economies. Depending on whether the school in question requires a one-time payment for the entire school terms or allows families to spread payments over months, the expense can put a significant dent in household finances .”1

In general, women and the poor are more likely than men, and more likely than adults with higher incomes, to worry about how they can cover monthly expenses.

What does all this mean for inclusive insurance? Building solutions that can help to address customers’ financial anxiety – by easing it – would appear to be the obvious conclusion. How can the insurance solution bring peace of mind, without simply representing an additional cost to already over-burdened households, with varying degrees of financial resilience?

Financial resilience

The financial resilience questions focused on how – and how quickly – respondents could come up with emergency funds representing one-twentieth of Gross National Income (GNI) per capita. If you’re interested to know how much money that would mean for you, check out the country data provided by the World Population Review here and simply divide the amount by 20. For example, if you live in the United States, in 2021 that would have meant coming up with USD 3,521.50 in a hurry. If you had to come up with this in seven days, or in thirty, how would you do it? Would you:

- Raid your savings?

- Beg family and friends (hoping they are not in a similar bind)?

- Earn it (bearing in mind you still have to cover your ordinary monthly expenses)?

- Borrow it, from a bank, employer or private lender (which we assume includes loan sharks)?

- Sell whatever you can, which might include your body?

Think about your answer, then do go and read this section in the Global Findex report. Because, while insurance isn’t the full solution, bundling it with savings and access to responsible credit go a long way to building financial resilience.

[1] Source: Demirgüç-Kunt, Asli, Leora Klapper, Dorothe Singer, and Saniya Ansar. 2022. The Global Findex Database 2021: Financial Inclusion, Digital Payments, and Resilience in the Age of COVID-19 (p. 165). Washington, DC: World Bank. doi:10.1596/978-1-4648-1897-4. License: Creative Commons Attribution CC BY 3.0 IGO