Reflections from ICII 2024: Using insurance to strengthen economies

The 20th International Conference on Inclusive Insurance (ICII), held in Kathmandu, Nepal, in October 2024, was hosted by the Nepal Insurance Association, Life Insurance Association Nepal, Nepal Microinsurance Association, and Nepal Insurance Authority, in collaboration with the Munich Re Foundation and the Microinsurance Network. The event represented another successful edition of the sector’s premier annual event as over 500 participants from 43 countries discussed opportunities and deliberated challenges in the inclusive insurance space. Several global, regional and local organisations shared their experiences on climate resilience, regulatory developments, narrowing the gender gap, product innovation and sustainable business models.

The event was a success for the Microinsurance Network (MiN). Representatives from around 77 companies were responsible for the conference’s rich content and lively debates. Among these, nearly 40% comprised members of the MiN. Of the 24 sessions held during the conference, all but three included a speaker or moderator from a MiN member – this highlights the Network’s success in sharing best practices and encouraging dialogue.

Why the Asia-Pacific region risks suffering the worst economic consequences

Like past editions, the ICII 2024 highlighted the state of microinsurance in its host region. Several speakers recalled the need for financial resilience in Asia and the solutions being implemented. While the global economy is increasingly vulnerable to pandemics, financial crises and climate change, such shocks disproportionately impact parts of Asia. These events can severely disrupt economic activity, strain public finances and lead to suffering and inequality (Figure 1).

ICII 2024. Opening ceremony.

For instance, in September 2024, just weeks before ICII 2024, Nepal was hit by three days of extreme and excessive rainfall. This shock claimed over 230 lives and left at least 173 people injured. The country now has to deal with costly damages: over $32 million in energy losses and nearly $20 million in infrastructure costs. Over time, the full humanitarian impact of this shock may lead to even higher losses for the Nepalese government.

Figure 1: A snapshot of the protection gaps in Asia, 2024

$886 billion The protection gap in Asia-Pacific – in terms of premiums

|

$1.8 trillion The health protection gap in Asia-Pacific

|

9% The potential economic losses insured in Asia-Pacific

|

26.5% Possible GDP loss due to climate crises in Asia by 2025

|

Source: Reinhard, D., (2024). Strengthening economic development through insurance

Sustainable business models: Learning from the Philippines and beyond

ICII 2024 included a dedicated session on the success of inclusive insurance in the Philippines. CARD MRI and Pioneer Insurance formed a partnership in 2007. Since then, nanays (Tagalog for “mother” or motherly agents in this instance) have made their venture a success. Trust and co-ownership of a dedicated microinsurance unit helped drive success. The product has worked because both partners listened carefully to their customers’ needs. CARD-Pioneer remains a benchmark in using digital technology: 96% of claims are processed within 24 hours, while claims are paid within five days via mobile money.

ICII 2024. Plenary 3 - Covering Nanay: The microinsurance journey of Card Pioneer Microinsurance Inc. (CPMI) in the Philippines.

While a separate unit, simple products and processes, and fast claims payments are good topline strategies, partnerships remain the cornerstone of successful services. ICII 2024 revealed several examples of this in Asia. For instance, in Bangladesh, Chartered Life Insurance has collaborated with different organisations to expand its reach. These include BRAC Microfinance, Sajida Foundation, WaterAid, USAID and the UNDP. Chartered Life has used existing networks’ goodwill and trust among would-be users to offer microinsurance products to low-income populations.

Busting inclusive insurance “myths” through the Landscape of Inclusive Insurance

Early insights from the Microinsurance Network’s annual Landscape of Microinsurance is an important fixture at every ICII. As of 2023, around 344 million people were covered by inclusive insurance products worldwide – up from 300 million in 2022 (Figure 2). This was driven by product innovation, particularly for health microinsurance services, and new distribution partnerships. While Asia Pacific has the largest share of global microinsurance policies (78%), only 13% of people are covered in the region. The 2024 Landscape will be published in the first quarter of 2025.

Figure 2: Share of microinsurance policies by region, 2023

Source: Microinsurance Network.

ICII 2024. Plenary 2 - The Landscape of Microinsurance: Bridging gaps, building futures.

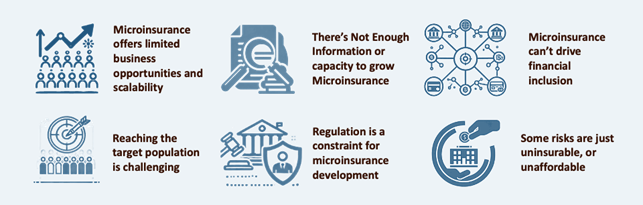

The Landscape session demystified several “myths” about microinsurance (Figure 2). Evidence from inclusive insurance providers demonstrates optimism and potential for growth. Among these, increasing product lines and partnerships show that products typically take three to four years to reach significant scale. Poor information is a regular challenge. However, improved data collection by non-governmental organisations found that women comprised around 70% of customers in some cases. Such insightful data can be used to better target underserved customer segments.

Figure 3: The six myths of microinsurance

Source: Microinsurance Network.

The gender gap: using insurance to financially empower women

The gender gap remains a pressing issue for microinsurance providers. Women face distinct risks compared to men, which can increase in severity when considering their differing financial and climate-specific contexts. In low- and middle-income countries, women play an unparalleled role in managing household finances and protecting their families from risks – often without formal risk mitigation solutions. While inclusive insurance solutions need to consider women’s distinct needs, regulators can support this process and increase women’s access to inclusive insurance by:

- Incentivising sex-disaggregated data collection and analysis,

- Creating an enabling environment for women-centric product development and launches,

- Improving consumer protection and empowerment,

- Increasing capacity-building, training and awareness, and

- Advocating for gender-sensitive solutions within national financial inclusion strategies.

Regulators in some countries have played an active role in narrowing the inclusive insurance gender gap. In Argentina, “Superadoras” were developed specifically to make female entrepreneurs more resilient against financial shocks. In addition, many regulators are attempting to collect more gender-disaggregated data - especially as fewer than half of the products covered in the Landscape of Microinsurance reported collecting disaggregated data on gender. There is a need for improvement in collecting data on women. Some initiatives, such as A2ii’s FeMa-Meter tool, already allow regulators and insurers to determine disparities between men and women.

Reflection points: Charting the evolution of inclusive insurance

As a milestone event, ICII 2024 took stock of progress in countries where some of the last editions had been held: Peru (2017), Zambia (2018) and Bangladesh (2019). In Peru, using microfinance institutions (MFIs) as distribution partners has helped to target more customers. Zambia’s success has been underpinned by the formation of the Microinsurance Technical Advisory Group, which has coordinated national efforts through multi-stakeholder engagement. In Bangladesh, partnerships with MFIs have allowed insurance providers to acquire more women customers than otherwise.

Figure 4: Selected statistics on microinsurance in Bangladesh, Peru and Zambia (2023)

|

Population: 174 million |

~6.5 million people covered* |

At least 11 products |

|

Population: 30 million |

5.3 million people covered |

68 products |

|

Population: 21 million |

4+ million people covered |

32 products |

Source: Adapted from the Plenary 7 presentations. ICII 2024. *Approximate figure based on research from 2009.

For Nepal, the ICII offered the chance to present lessons and set future milestones. So far, Nepal’s microinsurance journey has seen some success. The Nepal Insurance Authority has encouraged market development through various initiatives. Allowing standalone microinsurance companies has helped reach more rural and marginalised communities, as microinsurers have focused on the needs of these customers. Government subsidies have made agricultural insurance affordable for many farmers, while capacity-building efforts by international partners have improved local expertise in delivering quality services

Lessons learned: “There are no challenges – there are [only] opportunities.”

ICII 2024 provided a fresh perspective on well-known inclusive insurance topics. Many participants learned from experts they had heard of or read about, with the added benefit of interacting in person and expanding their networks. Beyond specific use cases, the most valuable lesson is one that can be applied anywhere: the right combination of political will, collaboration, and enforcement can bring about opportunities for effective solutions.

ICII 2024. Closing and outlook 2025.