Investment Opportunities and Approaches in Inclusive Insurance

Raimund Snyders, LeapFrog Investments

1. Introduction

Insurance is a core pillar supporting economic prosperity, health and well-being across the globe. It provides a safeguard against risk while offering a solution for savings. However, access to insurance remains limited to a privileged few, predominantly people and businesses living and operating in developed economies. Inclusive insurance aims to bridge this gap by providing affordable and accessible insurance products to unserved and underserved populations, including low-income individuals and small businesses.

Insurance contributes significantly to achieving nine of the Sustainable Development Goals, including No Poverty, Reduced Inequalities, Gender Equity and Decent Work, among others. Progress toward these goals is often measured through penetration (the ratio of premiums to GDP) and insurance density (premiums per capita). In emerging markets, insurance penetration is on average a third of that of developed markets and insurance density lags behind significantly, often below 5% of developed market levels.

This disparity underscores the immense opportunity and compelling business case for investing in the insurance sectors of emerging economies. In addition, rising risks associated with climate change, urbanisation, agricultural development, population demographics, technological advances, pandemic occurrences, geopolitical power plays, sovereign indebtedness, disproportionally impact vulnerable economies and populations. These dynamics emphasise the increased need to mobilise insurance capital and deploy it effectively to address an increasingly complex risk landscape.

This article explores various investment channels and approaches that support inclusive insurance, highlighting recent trends, challenges, and future opportunities.

2. Investment Channels Supporting Inclusive Insurance

Strategic Investors

Many multinational and global insurance giants, including reinsurers, have increased their exposure to emerging markets over the past decades. Companies like Swiss Re, Munich Re, SCOR and Hannover Re participate in risk management in various ways, such as through conventional reinsurance structures, as well as increasingly through partnerships and investments in insurance ventures or foundations to support insurance development. Similarly, companies such as Allianz, AXA, AIA, Prudential Investments, Prudential plc, and Chubb, are considerably expanding their operations to emerging economies. This approach brings the benefit of experience and skills from multiple markets, accumulated over decades of insurance development, along with the capital allocated to these economies. This is a key channel supporting inclusive insurance development.

Impact Investment Funds

Impact investing involves directing capital to projects that intentionally generate social and environmental benefits alongside financial returns. The impact investing industry is estimated to manage over $1.5tn in assets under management, expected to grow to $2tn over the next 5 years.

Examples include private equity firms TPG (through their Rise Fund), LeapFrog Investments, , Nuveen and, Triodos Investment Management. LeapFrog is regarded as a pioneer in impact investing with experience scaling multiple insurance investments across Africa and Asia and selling them on to leaders in the industry such as AXA, Allianz and Prudential. The firm’s current insurance investments include leading digital microinsurer BIMA, global Insurtech unicorn bolttech, top Indian insurance marketplace InsuranceDekho, and Southeast Asia’s largest insurtech PasarPolis, among others.

Blended Finance Approaches

Blended finance combines public and private funding sources to reduce investment risks and attract private capital to projects with high social impact. This approach is particularly effective in inclusive insurance, where public funds can be used to de-risk investments and encourage private sector participation.

InsuResilience Investment Fund managed by BlueOrchard Finance is one such example: leveraging public funds to attract private investments, this fund supports climate risk insurance initiatives to smallholder farmers and low-income households in developing countries. Example investments include AgriTask, Pula, Igloo and FinAgg.

Another example is the Global Innovation Fund (GIF), which uses blended finance to support innovative solutions, including insurance products, that address the needs of underserved populations. For instance, GIF provided a grant to the J-PAL health insurance initiative in India, to evaluate the effectiveness of health insurance schemes, including how access to insurance impacts healthcare, financial protection, and overall health outcomes for low-income populations. The data generated will assist policymakers to develop health insurance regulations and policies to improve health equity and reduce poverty.

Platforms such as Convergence, a global network for blended finance, have also been established to connect public and private investors to blended finance opportunities, including those in the inclusive insurance sector. Their mission is to support the funding gap that exists to achieving the UN SDGs and to this end they have been very successful in forming partnerships to fund development initiatives, transfer risks, and support market and product development. Examples include the Climate Investor One project, the Global Emerging Markets Window initiative and the Room2Run transaction.

Role of Venture Capital and Philanthropic Funds

Venture capital (VC) and philanthropic funds are essential for fostering innovation in inclusive insurance. VCs can provide early-stage funding to startups developing innovative insurance solutions, while philanthropic funds can support pilot projects and research initiatives.

Examples include the Omidyar Network, a philanthropic investment firm supporting digital technologies, including inclusive insurtech startups or the Gates Foundation which funds initiatives aimed at improving access to insurance in developing countries, such as their partnership with Nigeria's National Health Insurance Scheme. The Gates Foundation has also partnered with BlueOrchard and the InsuResilience Fund to provide agriculture insurance to smallholder farmers across emerging markets via their investment in Pula.

The Anthemis Group is a VC firm that invests in insurtech companies, including those focused on inclusive insurance solutions The firm’s portfolio includes YuLife, CowBell, Goji. Other VC firms with a similar focus include G-Squared, Alma Mundi, Connect Ventures.

3. Recent Trends and Growth Areas in Financing for Inclusive Insurance

Recent trends in inclusive insurance financing include the rise of digital innovation and microinsurance. Digital platforms and mobile technology have made it easier to reach underserved populations, offering affordable and accessible insurance products. As mobile network operators expand their services and customers increasingly use mobile money products, we see the uptake of insurance rising substantially. GSMA, a global organisation representing mobile operators and organisations in the ecosystem, provides regular evidence of this expansion. Barriers of awareness, affordability, access and trust that often hamper the take-up of insurance are increasingly overcome with these digital innovations.

Examples include Inclusivity Solutions, BIMA, miLife, AYO, SoftLogic Life — companies that use mobile technology and Mobile Network Operator (MNOs) partnerships to provide microinsurance products to low-income families in countries across Africa, India, Southeast Asia and beyond.

Embedded insurance has also become more acceptable and a more affordable way to distribute microinsurance solutions. This is particularly true for Asia, with high mobile penetration and rapid digitalisation. Some examples include PasarPolis, Southeast Asia’s largest insurtech company which partners with e-commerce platforms and ride-hailing services to offer microinsurance products; BIMA, who has managed to improve healthcare access and insurance penetration in countries like Bangladesh, Ghana, and Pakistan by integrating telemedicine services into its offerings; bolttech which has expanded its device protection services to include insurance coverage for home, accident and health insurance, serving millions of consumers across emerging markets.

Microfinance institutions (MFIs) often offer microinsurance products to their clients, providing a safety net for low-income individuals. These products are designed to be affordable and accessible, addressing the specific needs of underserved populations. The microinsurance solutions are often incorporated directly into the loans provided, i.e. another form of embedded insurance.

4. Choosing the Appropriate Investment Model

Access to capital investment to support insurance development is one of the biggest factors impacting insurance inclusion. The global economic and geopolitical climate is a major driver of capital allocations across markets, however factors such as economic stability, regulatory certainty, rule of law, quality of skills and availability of experience are also important.

When choosing the ideal providers of capital, businesses should consider their stage of development, risk tolerance, expected returns, and alignment with social impact goals:

- For startup businesses, venture capital may offer early-stage funding and flexibility required.

- Established businesses, however, may look to blended finance, public-private partnerships, and private equity funds such as impact investors to provide larger-scale funding, growth capital, governance and risk mitigation support. Social enterprises like philanthropic funds and impact investments align with the dual goals of financial sustainability and social impact, which might often be a more appropriate route to access capital.

- Well established and scaled businesses with a proven track record, strong governance structures and sound balance sheets could be attractive partners to strategic insurance enterprises looking to expand into emerging markets.

Funding can be provided in various forms, such as shares (i.e., equity capital), loans (i.e., debt funding requiring both interest and capital repayment), grants, subsidies, crowdfunding or peer-to-peer financing.

Government grants and subsidies can provide crucial support for inclusive insurance projects, especially in the initial stages. These funds help reduce the financial burden on businesses and encourage innovation. Relief can be in the form of capital, favourable interest rates or repayment terms. Some examples include:

- India's Ayushman Bharat: A government-backed health insurance scheme that provides coverage to over 500 million people.

- Kenya's National Hospital Insurance Fund: Offers subsidised health insurance to low-income families.

- Philippines' PhilHealth: Provides government-subsidised health insurance to millions of Filipinos.

Public-private partnerships (PPPs) bring together the strengths of both sectors to develop and scale inclusive insurance solutions. PPPs can provide the necessary funding, expertise, and infrastructure to reach underserved populations. Some examples include:

- African Risk Capacity: Combines public and private resources to offer climate risk insurance to African countries.

- India's PMFBY: A crop insurance scheme that involves collaboration between the government and private insurers.

- Mexico's CADENA: A disaster risk financing mechanism that includes public and private sector participation.

Crowdfunding and peer-to-peer financing platforms enable businesses to raise funds directly from individuals. These models can be effective for startups and small businesses, providing access to capital without the need for traditional financial intermediaries. Examples include:

- Kiva: Facilitates microloans for inclusive insurance projects, enabling individuals to lend small amounts to entrepreneurs in developing countries.

- GoFundMe: Used by startups to raise funds for innovative insurance solutions.

- Zidisha: A peer-to-peer lending platform that supports small businesses, including those offering microinsurance products.

6. Challenges and Considerations

Becoming Investment Ready

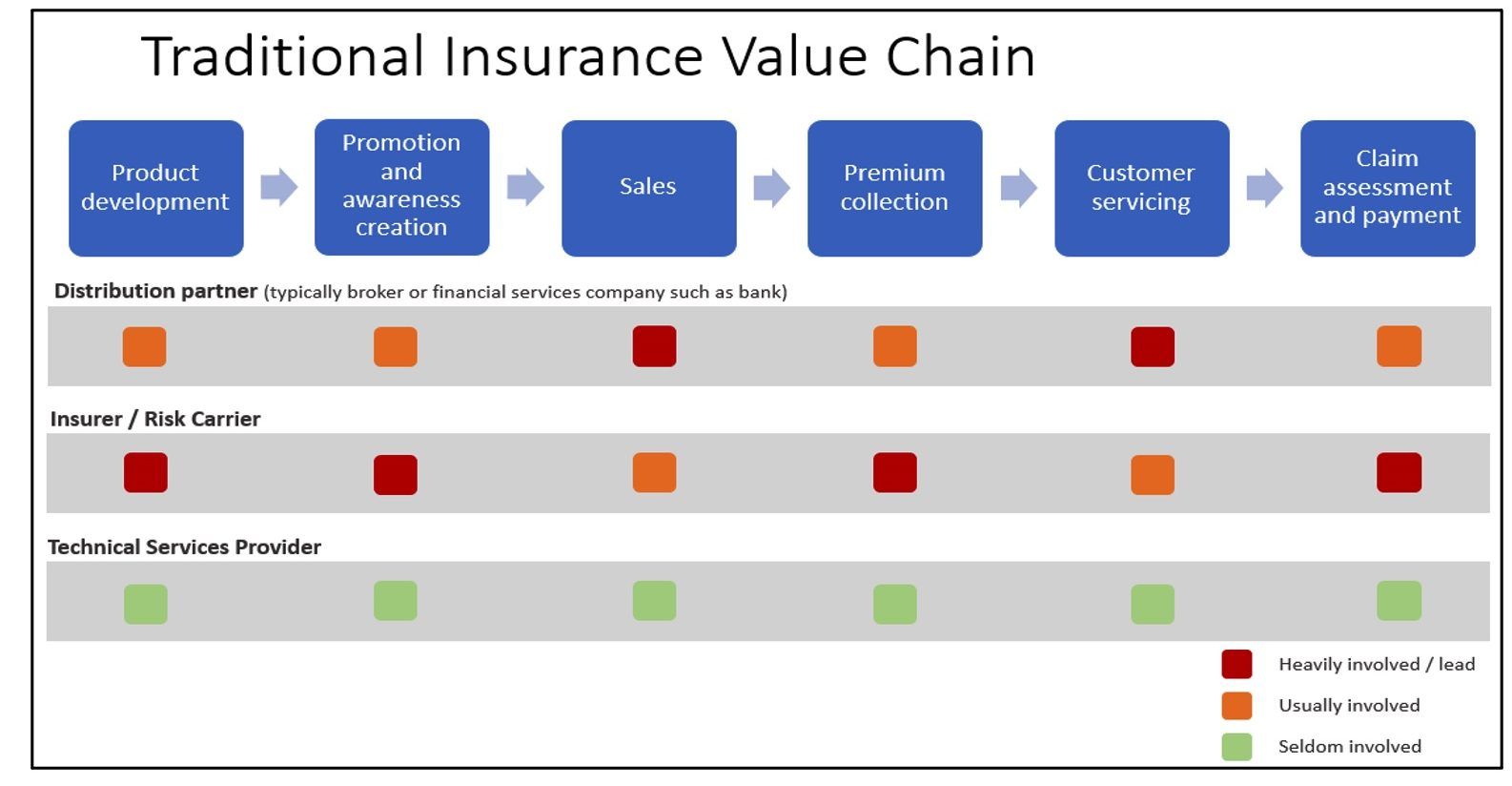

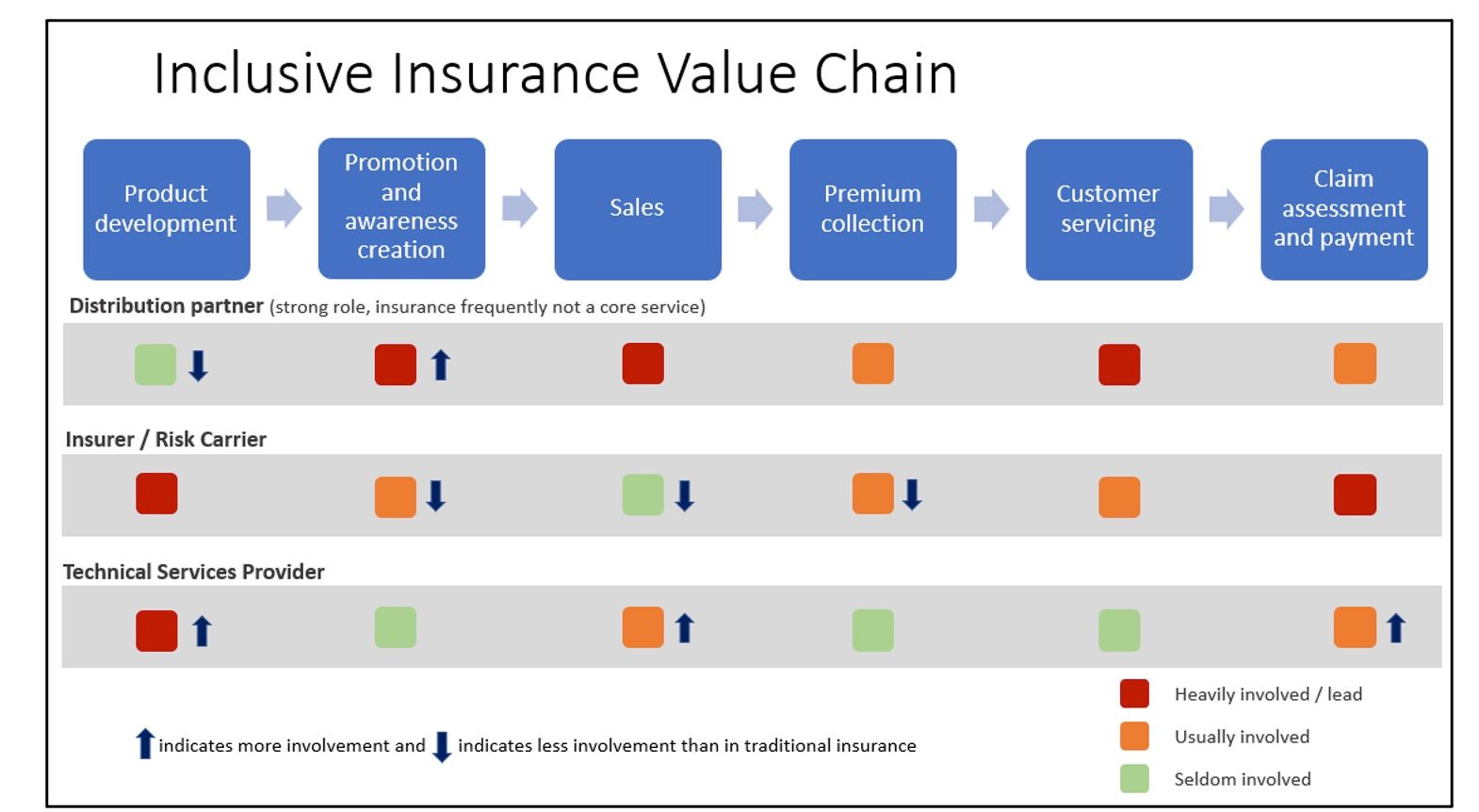

To attract investment, businesses in the inclusive insurance landscape must demonstrate their commercial viability and potential for meaningful impact. This requires developing a solid business plan, financial projections, and a clear value proposition. Building strong partnerships and showcasing successful pilot projects can also enhance investment readiness. Often, the key differentiator lies in the distribution model, including how products will be brought to market, at what cost and what mechanisms. Traditional insurance products are sold via agency channels although today, many solutions are delivered in partnership with bank channels, MNOs, or MFIs.

Common Challenges

Securing investment for inclusive insurance can be challenging due to regulatory barriers, lack of investor awareness, and risk management issues. Regulatory compliance can be complex and costly, while investors may be unfamiliar with the inclusive insurance market. Effective risk management strategies are essential to minimise potential losses and build investor confidence. Having appropriate governance structures in place, with qualified professionals in finance, actuarial science and operations are key areas that investors will be looking for as part of a decision to support an insurance venture.

7. Conclusion and Future Outlook

The insurance industry acts as distributor of risk and forms a crucial part of economic development for countries and regions. This is true both at macro and micro level. A smallholder farmer, or a trader in an informal market, appreciates the value of insurance when a fire, drought, flood, theft or illness impairs their ability to work and earn a livelihood. Added together, all the participants in the economy of a country, whether formal or informal, are impacted by national threats. Insurance plays a key role in weathering such risks and compensating for the losses suffered by unexpected and/or unknown events. The data shows that most emerging consumers in developing markets would fall back into poverty if exposed to shocks, without financial support.

Looking ahead, continued innovation and adaptation will be crucial for the growth of inclusive insurance to reach some of the most vulnerable populations of the world. Emerging trends include the increased use of technology, greater collaboration between public and private sectors, and the development of new financial instruments to support inclusive insurance projects.

Investing in inclusive insurance not only offers financial returns but also aligns with a broader mission of achieving profit with purpose. By addressing the needs of underserved populations, inclusive insurance can drive sustainable development and create a more equitable world.

Figure 1. IAA Risk Book - Introduction to Inclusive Insurance

Figure 2. IAA Risk Book - Introduction to Inclusive Insurance