Insurance and ESG: Transforming inclusive resilience in Latin America and the Caribbean

Latin America and the Caribbean (LAC) has faced several disasters over the last 10 years. Around 83% of disasters in the region are climate-related. These include devastating hurricanes in the Caribbean, prolonged droughts in the Southern Cone (i.e., Argentina, Chile, Uruguay and Paraguay) and flash floods in Central America. Worsened by the impact of climate change, these events have exposed the region’s vulnerability: expected annual disaster-related losses are estimated at USD 58 billion. This highlights the need for stronger community resilience.

However, according to the 2024 Landscape of Microinsurance Study, there are now more microinsurance products targeting climate-related risks - with the LAC region seeing growth:

- The number of products where climate risk is the primary coverage or embedded alongside other risks rose to 112 in 2023, up from 51 in 2020.

- In Latin America, products offering climate risk as the primary coverage increased from five in 2020 to 21 in 2023.

- Financial institutions are helping to scale access: 52 climate-risk microinsurance products are now distributed through financial institutions globally, 17 of which use them as their main distribution channel.

- Globally, the number of people covered by these products grew from 1.4 million in 2020 to over 42 million in 2023. In Latin America, coverage increased from 39,000 people to 1.1 million over the same period.

This expansion reflects the insurance sector’s commitment to tackling the impacts of climate change, particularly for vulnerable populations. Despite this progress, much more remains to be done: protection gaps persist across the LAC region, as recent crises have made abundantly clear.

Extreme climatic shocks can have a devastating impact

The droughts in Uruguay in 2022 and 2023 are an example of the impact of extreme climatic events. These were caused by the La Niña weather phenomenon, combined with rising temperatures. The droughts were the worst in 70 years and affected more than 1.7 million people, half of the country’s population. The resulting economic losses were estimated at over $1.88 billion, equivalent to 3% of the country’s GDP. Agricultural losses exceeded $1 billion and disrupted water supplies for both rural and urban populations.

Uruguay’s example also highlights the limited reach of insurance cover in the region. The droughts were declared an emergency, which allowed the Ministry of Livestock, Agriculture and Fisheries to support affected farmers. Some received cash transfers, both from the government and the Red Cross. Only families in the most affected areas received aid from the Red Cross. The cash transfers were designed to partially offset losses and help to maintain livelihoods. However, the targeted approach meant that not all affected families received support.

Globally, environmental and social risks are becoming more severe

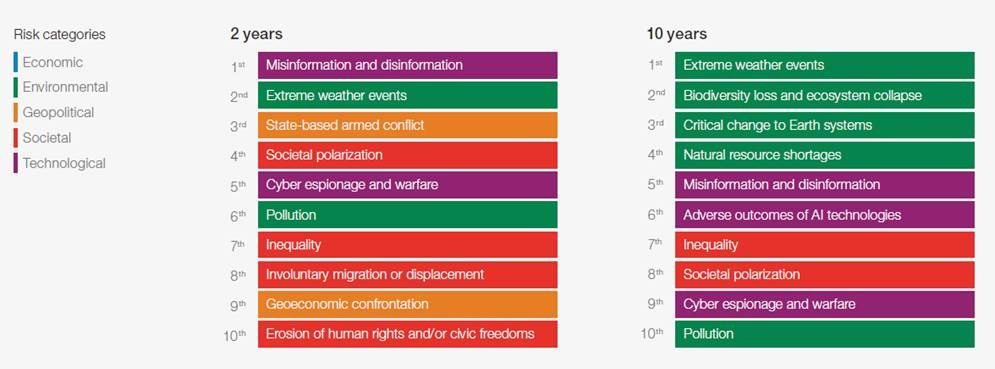

This is not an isolated event: environmental and social risks have become a major long-term concern. Extreme weather events, ecosystem collapses and economic inequality are considered the most severe threats for the next decade. The World Economic Forum advocates for urgent and coordinated action to build resilience and improve preparedness. This is necessary as biodiversity loss, forced migration, the erosion of human rights and natural resource scarcity could reach irreversible tipping points before 2035.

Figure 1: Global risks ranked by severity over the short and long term

Source: World Economic Forum Global Risks Perception Survey 2024 – 2025.

Source: World Economic Forum Global Risks Perception Survey 2024 – 2025.

Beyond transferring risk, the insurance industry now plays a key role in promoting sustainability. Many insurers have proactively mitigated the impact of climate change and promoted sustainable practices. These initiatives include investing in green projects and encouraging responsible behaviour among policyholders. Simultaneously, inclusive insurance is seen as an essential tool to protect the most vulnerable communities. These products offer a financial safety net to communities that are traditionally excluded from formal insurance: smallholder farmers, informal workers and indigenous communities

Inclusive insurance has the potential to drive the sustainability agenda

The insurance sector’s sustainability efforts on investment management and environmental risk mitigation are a positive step, but are not enough. These approaches have often overlooked the deep integration of social and governance impacts in insurance operations. Sustainability involves integrating environmental, social and governance (ESG) criteria into all strategic and operational decisions made by insurers. This goes beyond financial risks to take account of insurers’ long-term effects on society and the communities they serve.

Inclusive insurance can be used to rebalance this potentially uneven approach. By serving communities and market segments excluded from the formal economy, inclusive insurance can reduce the protection gap. This also offers a fairer and more development-oriented solution. As a result, inclusive insurance can be tangibly used to translate ESG commitments into real and measurable impact metrics. This can help to strengthen both social sustainability and the sector’s long-term profitability potential.

Several actors are trying to drive sustainability – both globally and in LAC

Globally, several actors are involved in promoting initiatives to encourage greater involvement and commitment from the insurance sector towards sustainability. For instance, the Principles for Sustainable Insurance (PSI) serve as a guiding framework. The principles were developed and are promoted by the United Nations Environment Programme Finance Initiative (UNEP FI). The framework encourages insurers to assess and manage ESG risks across all their business lines, to engage with stakeholders and to report in a transparent manner.

In LAC, the Bogotá Declaration on Sustainable Insurance (DBSS) was launched to adapt the global vision on ESG to the region’s realities. Launched in 2024, the DBSS is a collective commitment by the insurance industry and other stakeholders to actively contribute to the Sustainable Development Goals (SDGs). To date, around 40 institutions in the region have signed the declaration, affirming their desire for a more resilient, fair and environmentally aligned insurance sector.

The DBSS promotes ESG integration while driving the development of inclusive products across the region. It also advocates for technical staff training and institutional collaboration to tackle climate, biodiversity and social risks. Importantly, the Declaration has established links with other international agreements. These include the Kunming-Montreal Global Biodiversity Framework and the commitments made at COP 28.

The LAC is seeing more biodiversity insurance mechanisms emerge

One example of a regional mechanism for improving sustainability, inclusion and biodiversity is the Mesoamerican Reef Fund (MARFund). The MARFund is a partnership between local insurers and international actors to conserve and restore the Mesoamerican Reef. The Fund has developed a parametric insurance product for coral reefs in Belize, Guatemala, Honduras and Mexico. This triggers automatic payouts after major storms for rapid reef restoration. The scheme protects a key biodiversity ecosystem and sustainable tourism, while involving coastal communities in recovery efforts. This may help to generate employment and strengthen local resilience.

Some countries, such as Argentina and Colombia, have also launched initiatives, typically through partnerships. In Argentina, Río Uruguay Seguros (RUS) launched the world’s first insurance product designed to protect the jaguar (yaguareté) in 2024. The product was launched in partnership with the Government of Misiones province, the UNDP and other specialised organisations. It was designed to protect an endangered species and the rural communities that coexist with it. The provincial government purchases the insurance via a collective policy. It covers local farmers in the event of verified predation by jaguars. In addition to compensation, it includes a technical support plan to improve livestock management and prevent future incidents.

In Colombia, Fasecolda led the country’s first national mapping of green insurance using Colombia’s green taxonomy as a reference framework. This inventory identified insurance products that can support the transition to a cleaner and more resilient economy. The products include sustainable agricultural insurance, renewable energy coverage, environmental liability policies and green bond investment mechanisms. This exercise highlighted the potential for the insurance sector to contribute to climate action. In addition, it presented criteria to classify, develop and strengthen products aligned with the SDGs and the country’s climate commitments.

ESG can make insurance more than just indemnifying losses

The examples from the LAC region show that insurance can be used for communities to anticipate risks, adapt and transform their approach to risk management. Integrating ESG into inclusive products can better target historically excluded communities and ensure the financial system recognises, protects and values them. Sustainable inclusive insurance presents a dual opportunity: insurers can expand into new markets while becoming active agents of sustainable development. In doing so, insurance can transcend being a business line to connect profitability with purpose, innovation with social justice, and financial protection with climate resilience.