Instinct or insights? Why inclusive insurance needs customer-centricity

In an environment where millions worldwide are facing an economic squeeze, how should insurance providers respond? Inclusive insurance providers, like other businesses, need to keep their customers informed and engaged - and pursue an approach whereby the customer is at the heart of their business development strategy. By using customer insights and data effectively, businesses can not only grow but crucially deliver relevant and timely insurance solutions to help close the people protection gap.

With more customer data now available than ever before, some inclusive insurance providers have already gone down this route. A notable example is Pioneer Microinsurance (“Pioneer”) from the Philippines, whose leadership has long advocated the need to transition to a customer focus, away from a product-based approach. Pioneer set up a dedicated business unit to create a positive experience for its customers and in particular, develop products and services aimed at meeting the needs of underserved and low income customers.

Shifting to this model is not merely a simple case of doing away with existing ways: as much as data is increasingly available, knowing what to do with it is critical. The next step is to ensure that knowledge and enthusiasm for data-based methods trickle throughout the rest of an organisation, and become embedded in its approach and culture. Then comes the process of using data for impact. This is where there can be a significant challenge: beyond understanding the power of using data to develop a customer-centric approach to growth, how should business leaders demonstrate this?

In 2018, CGAP published a toolkit to support financial service providers in becoming more customer-centric, based on the experience of several organisations pursuing such an approach. One of these was Pioneer, which started its pilot with CGAP in 2015. As the company had been expanding, maintaining its usual positive customer experience became challenging – leading to low retention rates. By using the toolkit, Pioneer was able to obtain qualitative data about customers’ specific needs and as a result, the company grew rapidly - with a strong focus on creating a positive experience for its clients in key areas such as communication and the swift payment of claims - and within five years, its customer base had grown from 266,000 enrolments to 18 million.

Customer-centricity can lead to products that may increase customer activity, which can translate into increased revenues and crucially, more relevant products for the underserved. According to 60 Decibels, listening to customers and effective communication with them are crucial first steps to becoming customer-centric. An efficient way of doing this in many low to middle-income countries is through mobile phones: in 2022, there were 5.4 billion unique mobile subscribers globally. Not only can mobile connectivity make it easier to reach new and existing customers, but it can generate valuable data on customers. Such customer data can be used to design more inclusive products and services, and have a significant impact along the entire inclusive insurance value chain.

To ensure that data is both useful and impactful, however, it must be relevant, readily available, actionable and provide tangible value-add. Much of the impact data currently available and used does not always meet these characteristics. Headline statistics are powerful in showcasing the number of people reached and demonstrating social impact, but may not align with the behaviours and needs of individual customers or communities.

Such numbers, which can sometimes comprise proxy calculations, are often used for communicating major messages. However, these numbers can neither drive operational or design choices for insurance providers, nor even encourage any inward investment. The main challenge is to acquire context-specific data to understand the experiences of different customers that insurance providers might be targeting. After all, a solar panel owner in India will likely experience a different outcome compared with the owner of a similar panel in Tanzania.

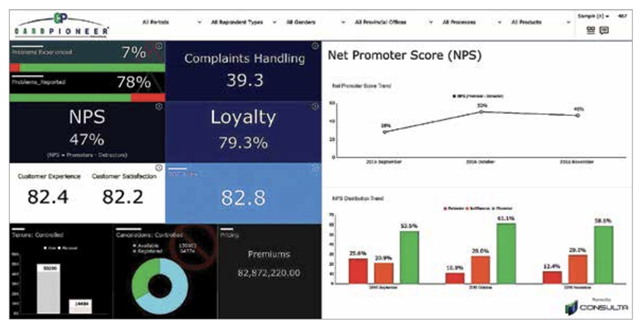

To understand its customers better, Pioneer launched a programme to improve its data capabilities in 2016. This included strengthening its data capabilities, including customer and agent journey mapping, establishing a voice-of-the-customer (VOC) instrument, and developing a dashboard for improved decision-making. Each of these initiatives involved collecting data, generating insights, creating and testing solutions, and scaling. The VOC led to a live dashboard that tracked customer experience, the incidence of issues and how they were handled, customer satisfaction, and loyalty through an overall integrated index score.

Figure 1: Pioneer Microinsurance’s customer experience dashboard

Source: CGAP, (2018). Pioneer Microinsurance – Building a Business Around Positive Customer Experience Pays Off

Becoming customer-centric isn’t a simple case of speaking to customers to understand their needs: data literacy at the top should define an organisation’s approach to business. Focus group discussions might seem like an easy place to start becoming customer-centric. After all, the resulting data can be used to gather customer insights and provide an opportunity for feedback when designing an inclusive insurance process. For example, the gender gap can be better understood and filled by understanding women’s needs and constraints. Before this, it is important to ensure that an organisation’s culture reflects and actively promotes customer-centricity.