Index insurance innovation: Protecting families against extreme heat in India

The last two years have seen at least three heat index-based inclusive insurance products emerge. While it is no surprise that each was launched in India – where a 2022 heatwave led to farmer incomes declining by around 50% – it shows how index insurance can be used beyond agriculture. This column has previously featured two of these products: one on livestock and one on women co-operative members in Ahmedabad.

The latter product was targeted at urban environments, where informal workers in cities stand to lose income due to excessive temperatures. For instance, food vendors and market traders may be hit by lower foot traffic as people stay inside. Home-based workers may suffer too, as many are likely to avoid working during hot afternoons, reducing their productivity in the process.

A similar third product was launched in 2024 by Mahila Housing Trust (MHT) – a grassroots organisation that has been providing microfinance to low-income women in the informal sector in India since 1994. MHT aimed to use the scheme to protect incomes and cover expenses, which can rise during heat waves. For example, MHT found that members had to spend more on electricity to run fans and bought more cold drinks for their families to stay cool and hydrated.

The initiative behind this product started in 2015 when MHT started a programme on climate change solutions. MHT has typically focussed on women in Ahmedabad and the surrounding areas, which are among the hottest places on the planet. Many of the women MHT worked with found that their daily lives were being affected by the impact of climate change. As a result, MHT adopted a strategy to help them. This strategy was made up of three elements:

- Educating women on climate risk, physical resilience and financial solutions for their communities to invest in evidence-based vulnerability assessments and risk reduction methods;

- Demonstrating sustainable housing and other solutions, such as cool roofing, energy-efficient products, flood alerts and prevention solutions to build physical resilience; and

- Providing access to loans via credit co-operatives to invest in these solutions.

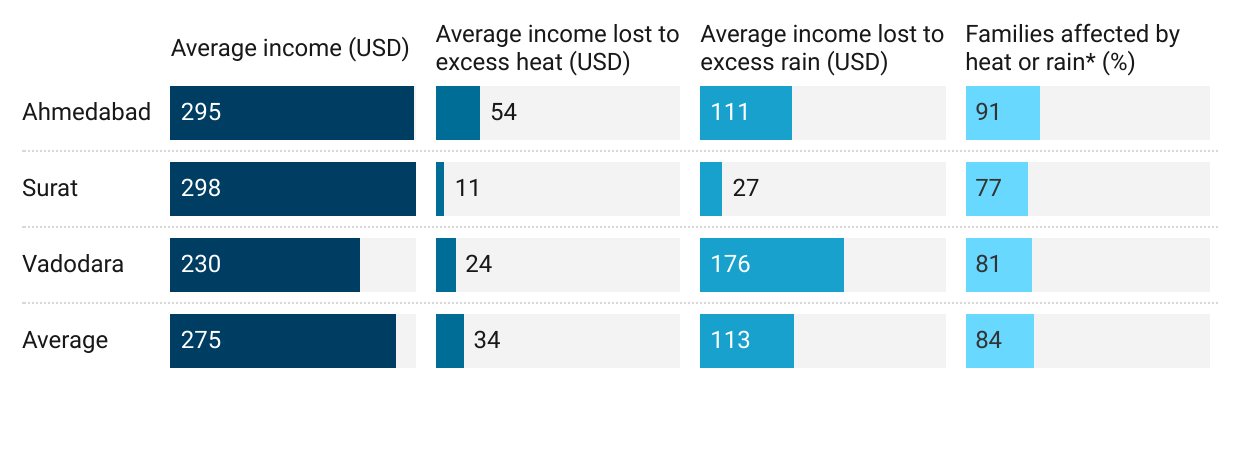

Despite these efforts, inadequate housing and municipal services forced many low-income households, women in particular, to bear the brunt of extreme climatic shocks. Many women were facing significant bills due to young and elderly family members being admitted to hospital for dehydration treatment, despite access to credit. MHT conducted group discussions with its members in the aftermath of the 2022 heatwave. Through there, it found that families in Ahmedabad, Surat and Vadodara – three of the largest cities in the western state of Gujarat – remained highly vulnerable to the impact of excessive heat (Figure 1).

Figure 1: Statistics on the impact of excess heat and rain on families in Gujarati cities

Figure 1 Notes: * Based on a limited survey of women in each city. Source: Mahila Housing Trust.

As a result, MHT developed its Climate Risk Insurance solution for the women it has been working with. MHT worked with several partners to design and launch a heat index insurance product: Global Parametrics (the Natural Disaster Fund manager), Howden and Go Digit Insurance. The product took advantage of existing ways of using temperature-based indices to provide income loss relief to affected families.

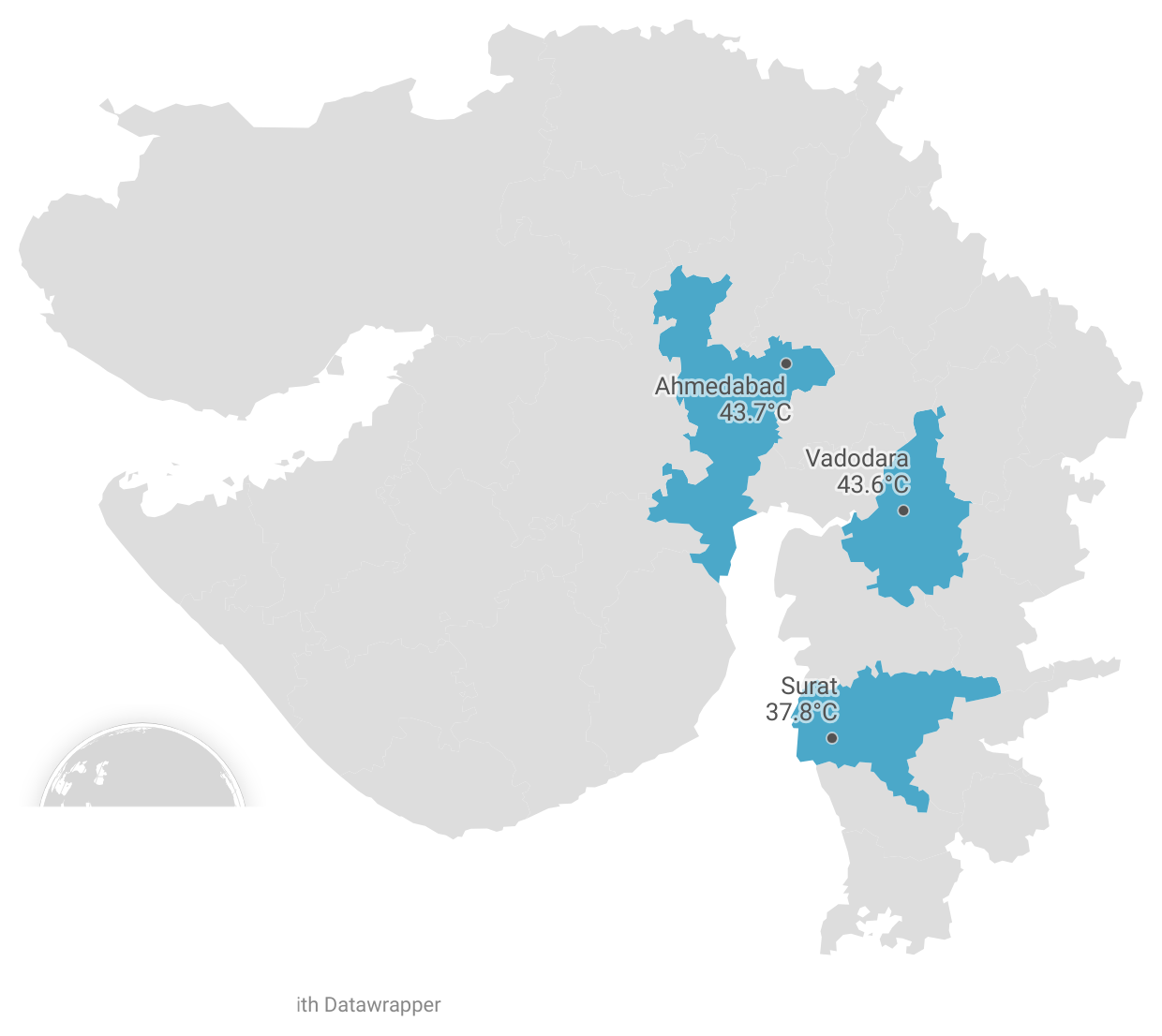

The product was designed to offer financial protection against extreme heatwaves for women working in the informal sector in Ahmedabad, Surat and Vadodara. Based on historical weather data, two trigger temperatures were set for each city: a lower trigger based on a five-year return and a higher trigger based on a 20-year return (Figure 2). While these temperatures varied by city, the premium payable and the claim payouts were the same: policy premiums were set at $4.5 per family, with claim payouts set to a maximum of $25 per beneficiary. Payouts are based on two consecutive days of the threshold temperature being breached during the product term.

Figure 2: Lower trigger temperatures by city

Source: Times of India, (27 April 2024). 26k families in state insured against extreme heat events

“More than half of the policy-holders in the three cities are affected by heat with rising costs for food, electricity and cooling. The cover will provide financial aid in case of loss of income. It will work as an awareness tool to check for extreme events.” Bijal Brahmbhatt – Director, Mahila Housing Trust |

The product was designed to cover two to three days’ worth of income lost by women during periods of extreme heat over the 2024 summer months. Between April and July 2024, MHT ran an initial pilot for 26,000 women across the three cities. These women were members of credit co-operatives that MHT works with. By the end of the pilot phase, the scheme was seen to have yielded positive results. On 23 May 2024, the lower threshold was triggered, leading to a payout for 2,000 women in Ahmedabad.

Figure 3: Pilot product cover details

| Product term | 1 April – 31 July 2024 |

| Beneficiaries | 26,000 women in Ahmedabad, Surat and Vadodara |

| Total premiums collected | $115,000 |

| Total sum insured | $650,000 |

| Value of claim payouts | $18,750 |

| Beneficiaries paid out | 2,000 |

Source: Mahila Housing Trust

The lasting outcome of the product

MHT found that several beneficiaries from the scheme used payouts to manage heat-related conditions, such as heat strokes and sunburns. In one particular case, a beneficiary in Ahmedabad used the claim payout to access care for her disabled daughter, who had been affected by a heatstroke. The scheme’s value was felt beyond its beneficiaries: many women who had not joined the scheme but had monitored the rising temperature understood how the scheme might have helped them. These women plan to sign up for cover when the product is next available. These stories are powerful reminders of how much innovation is still possible in inclusive insurance. Importantly, they also highlight one way of not leaving anyone behind.