Improving health outcomes: tackling NCDs in the context of inclusive insurance

Noncommunicable diseases (NCDs) are increasingly the biggest health threat to humanity, killing 41m people per year - equivalent to 74% of all deaths - according to the WHO. The growth of these diseases could be considered a symptom of our modern world, as many are driven by rapid unplanned urbanisation, globalisation of unhealthy lifestyles and population ageing.

Middle-to-low- and low-income countries, where more than 80% of pre-mature NCD deaths occur, are disproportionately affected, yet their healthcare systems are not equipped to deal with them. On a per-capita basis, healthcare spending in low-income countries is significantly lower than in high-income countries, and whilst global healthcare expenditure has increased in recent years, reaching 9.8% of global GDP, it has done so unevenly with high-income countries accounting for around 80%. Health spending in low-income countries is dominated by out-of-pocket expenses (44%) and external aid (29%) and these countries also face a double – sometimes triple – burden of disease. Not only are they continuing to fight against infectious diseases such as AIDS, tuberculosis and malaria, and in some cases child and maternal ill-health, but they now must also tackle the rise of NCDs, further burdening healthcare systems.

This presents an opportunity for the inclusive insurance sector to support low-income countries in tackling this challenge. And because prevention is better than a cure, by helping to stop NCDs in the first place, the microinsurance industry can help create a healthier world. This was the key topic of discussion during the Microinsurance Network’s June Member Meeting: “Improving Health Outcomes: Focus on NCDs.”

Awareness of the risk factors is crucial

The four leading causes of death from NCDs are heart disease, cancers, diabetes and respiratory diseases. However, many of them are preventable. In fact, as Jaimie Guerra, External Relations Officer for the Department of Communications at WHO explained during the meeting, 86% of deaths from heart diseases – the biggest killer globally – could have been prevented or delayed. This is because their causes are often linked to external factors including tobacco, alcohol, physical activity and diet. The rate of NCDs increase in low-income countries as they become more developed and populations begin to adopt the unhealthy lifestyles of developed countries which are often seen as signals of affluency: ultra-processed food, high-sugar and high-salt diets, increased alcohol consumption and a dependency on car transportation. This situation has simultaneously been exacerbated by climate change as the amount of usable land to grow crops is being greatly reduced, as is the case in Barbados. This forces a dependency on imported foods – in some cases up to 90% of total food required – most of which are ultra-processed.

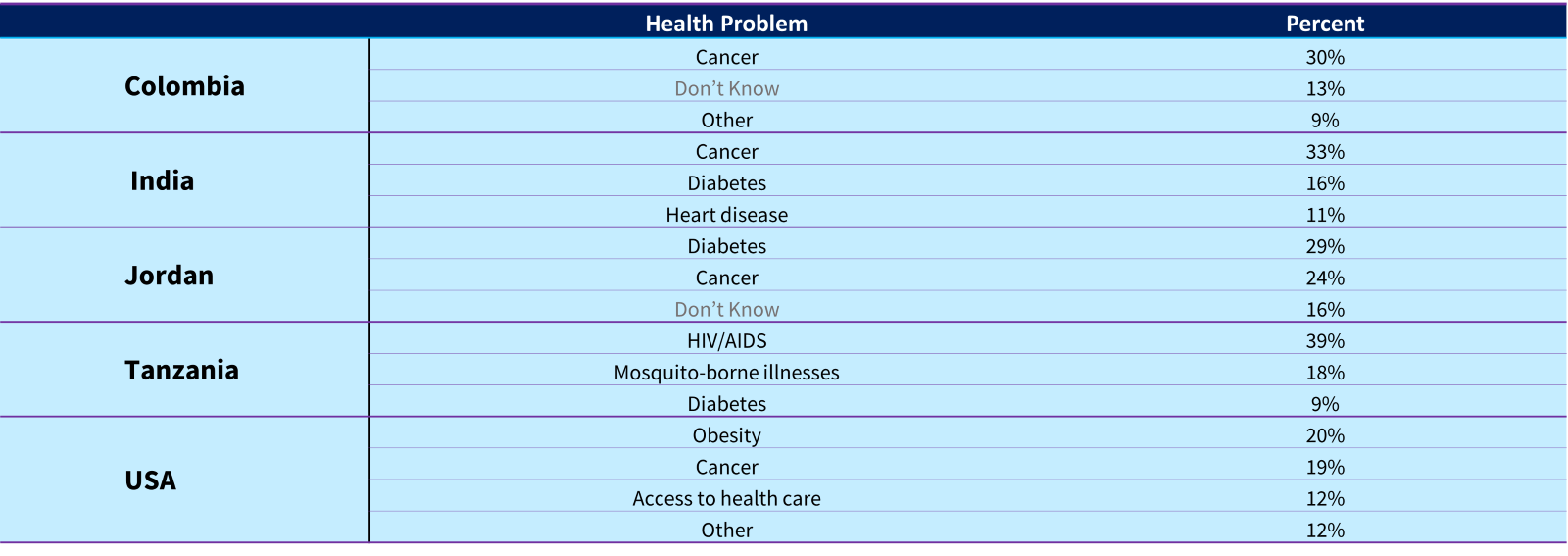

However, whilst people are aware that NCDs and their risk factors are top health problems in their countries, many do not understand the link between them and often underestimate their harm. This was revealed in a cross-country survey (Colombia, India, Jordan, Tanzania and USA) which measured public attitudes and understanding of NCDs. For example, many of the respondents did not see lung diseases and diabetes as being ‘very harmful’ compared to cancer, heart disease and stroke. ln countries such as India and Tanzania, diabetes was ranked as a lower concern compared to other health concerns, such as cancer (India) or infectious diseases, including HIV/AIDS and mosquito-borne illnesses (Tanzania). In Colombia and the USA, it didn’t appear in the top three concerns.

Figure 1: The First Cross-Country Survey to Measure Public Attitudes and Understanding of Non-Communicable Diseases.

Other than COVID-19, what is the biggest health problem in this country? (Top three responses, by country)

There is also significant room for improvement in the general awareness of the link between risk factors and NCDs. Whilst there was a higher awareness of the impact of tobacco – between 68-83% of respondents across all countries stated that it would significantly increase the likelihood that someone will get a noncommunicable disease – for all other factors, the percentage range was lower. Awareness of the risks is crucial, as it can help to prevent NCDs occurring. For example, with diabetes, where there is a difference between Type 1 and Type 2. Type 2 is linked to obesity and can therefore be prevented, or even put into remission in existing cases, through lifestyle and diet changes.

There is also significant room for improvement in the general awareness of the link between risk factors and NCDs. Whilst there was a higher awareness of the impact of tobacco – between 68-83% of respondents across all countries stated that it would significantly increase the likelihood that someone will get a noncommunicable disease – for all other factors, the percentage range was lower. Awareness of the risks is crucial, as it can help to prevent NCDs occurring. For example, with diabetes, where there is a difference between Type 1 and Type 2. Type 2 is linked to obesity and can therefore be prevented, or even put into remission in existing cases, through lifestyle and diet changes.

There are many cost-effective ways of preventing and controlling NCDs. These are outlined in the 28 WHOs Best Buys, and include evidence-based options to reduce the main risk factors, such as increased taxes on tobacco, alcohol and high-sugar products, the promotion of physical activity, and the introduction of screenings and vaccinations where appropriate.

<img class="image_resized" style="width:601px;" src="https://min-media.s3.eu-west-1.amazonaws.com/image_f3d1910560.png" alt="A picture containing text, screenshot, logo, heart

Description automatically generated">

The role of inclusive insurance in tackling NCDs

The inclusive insurance sector also has a role to play in supporting the prevention and control of NCDs, particularly within low-income countries where the cost burden of healthcare is usually on the individual. According to Guerra, insurance companies are uniquely placed to reach consumers with messaging and incentives to improve their health. She went on to highlight several ways they can do this, including: covering the cost of HPV vaccines; offering products with information on healthy lifestyle choices to prevent and manage NCDs; providing telemedicine and digital health solutions; implementing incentives for healthy behaviour (e.g. a steps programme for physical activity); and including disease management, such as screening and risk assessments, as part of their offering. This thinking is aligned with recommendations from the ILO’s Impact Insurance Facility. Lisa Morgan, Technical Specialist at the ILO, who facilitated the session, encouraged insurers in the room to think about their role in combating the rise in NCDs by including health value-added services and/or public health messaging as part of an integrated risk management approach; regardless of the underlying type of inclusive insurance scheme, it makes sense to have healthy clients/members and benefits all involved. There are several insurance companies already offering inclusive solutions with NCDs in mind.

In Thailand, for example, AXA are helping individuals to identify their risk of heart disease from hypertension. As Laura Rosado, Strategy & Finance Manager of the Emerging Customers team , highlighted during the member’s meeting, many people do not realise they have hypertension. As a result, AXA ran a campaign called “Know your heart” which enabled users to estimate their heart age and risk based on behavioural factors such as their physical activity, their age, diet and whether they smoke. For higher risk customers, they were invited to do a blood pressure check-up for free at a pharmacy chain, and also provided suggestions of how they could improve their health.

Microinsurance and telemedicine service provider, BIMA, are working across Africa and Asia to help individuals manage NCDs. Across the two continents there is inadequate health infrastructure and healthcare expenditure per capita is less than USD 100 annually. There are fewer than two doctors per 1000 people and less than 4% insurance penetration across the region. As a result, BIMA offers affordable and accessible digital solutions to help customers manage their chronic diseases. Sosthenes Konutsey, Head of Corporate and Partnerships at BIMA in Ghana, explained that this includes weekly coaching tailored to their specific disease (e.g., hypertension or diabetes), weekly lifestyle coaching, reminders for relevant check-ups and assessments, and monthly follow-up phone calls.

During the meeting, Konutsey also highlighted several empirical health outcomes resulting from these interventions. For example, for those on the hypertension pathway, 71% of onboarded subscribers submitted a blood pressure reading within three months. And, as of April 2023, 79% of subscribers who submitted three or more readings saw an improvement compared to their baseline readings. And for those on the diabetes pathway, the story is similar with 76% of subscribers who submitted three or more blood glucose readings seeing an improvement compared to their baseline readings, as of April 2023.

Other inclusive insurance providers are taking steps to tackle NCDs earlier in life. For example, Erik Jarrin Peters Global Head for Micro & Inclusive Insurance at Barents Re explained how there are some initiatives in Latin America that are looking forward to relying on popular sports like soccer as a trigger for prevention in nutrition, dental and mental health in children and adolescents. They aim to generate a freemium digital platform (financed by sponsors and donors) for children and their parents to get tips and advice on how to care for their health and lead healthy lifestyles within their budget, and gain rewards for demonstrating healthy routines. This programme would be coupled with health microinsurance. As Jarrin explained, by centering it around football and involving ambassadors from the sport the reach could be enormous. For example, in Latin America where football is incredibly popular, there are more than 38m children in low-income homes.

NCDs will continue to increase the financial burden on countries and individuals if no action is taken. Given that so many of these diseases are preventable, it makes sense to invest early in education, screening and medical support that can stop NCDs altogether. There is also work to be done in understanding the impact that climate change has on the lifestyles of individuals, and how this contributes to the increase in preventable diseases. In all these situations, the inclusive insurance industry can play a unique role in both educating individuals – through incentive programmes, for example – and helping them to access affordable ways to manage their conditions.