Human-wildlife conflict insurance: Early lessons from Kenya’s tech-based pilot

Human beings and wildlife have coexisted for many years. However, the increasing frequency of this coexistence has led to growing concerns about conservation and development. A significant challenge that has emerged is the growing incidence of human-wildlife conflict (HWC), which can affect human beings and animals alike.

HWC occurs “when animals pose a direct and recurring threat to the livelihood or safety of people, leading to the persecution of that species”. It has imposed additional costs on smallholder farmers and pastoralists, especially in low- and middle-income countries. This can include losses due to crop damage, livestock injury or death, property damage and human injury or death. To reduce the impact of HWC, national wildlife authorities have attempted to use fences, cull problem animals and provide financial compensation – with limited success.

In Kenya, HWC has become a growing problem (Figure 1). In January 2024, AB Entheos – as part of a consortium – launched a two-year pilot programme for a new insurance claims administration scheme for HWC in Kenya. The Kenyan government had previously established a HWC compensation scheme. However, manual processes and errors had led to delays in processing over 14,000 claims worth $40 million by the end of 2023.

Figure 1: The impact of human-wildlife conflict in Kenya

370 People killed by wild animals between 2020 and 2022 |

50-120 Problem animals shot per year by wildlife authorities |

2,000 People injured by wild animals between 2020 and 2022 |

Sources: Malesi, T., (2023). Biting drought fuels human-wildlife conflicts in Kenya, Horn of Africa, and IIED, (2024). Insurance to promote human-wildlife coexistence: A guide for governments, conservationists and insurers

How this scheme differs from existing approaches

Together with Pula, Minet, a pan-African risk solution provider, and the Kenya Wildlife Service (KWS) AB Entheos developed a digital platform to speed up claims payments. The consortium has been supported by conservancy umbrellas in identifying locations to deploy the scheme with the highest incidences of HWC. Some of the conservancy umbrellas include the Taita Taveta Wildlife Conservancies Association (TTWCA) and the Laikipia Conservancies Association (LCA).

The digital platform was designed to offer an end-to-end solution. Claimants can dial a USSD shortcode, which informs a nearby claims verification officer (CVO), local KWS officers and the insurance company. The CVO then travels to the claimant’s farm to validate the claim, and uses an app to collect testimonials and photos of the evidence. This data is then used by the insurance company to assess the claim and determine whether a payment should be made. The scheme aims to pay verified claims within 30 days for property damage and 90 days for death or injury.

“In 2019, when we first started working on HWC, we did not realise that the journey would be this long. But over five years later, we are pleased that the product has been implemented. We are delighted to see communities that have unfairly borne the financial burden of co-existing with wildlife being compensated quickly and fairly,” Barbara Chesire – Managing Director, AB Entheos |

Claimants and consortium providers have benefitted by using digital technology

This approach has presented several advantages when processing claims: real-time data collection for evidence verification and no need for physical forms to be certified. This may help to lead to higher claims approval ratios. Claimants will benefit from faster payouts, fair and equitable compensation and greater transparency by being able to keep track of progress. The scheme still relies on human input. However, the use of locally based CVOs with knowledge of affected environments has helped when invalid claims have arisen. Ultimately, the system aims to improve human-wildlife coexistence and community attachment.

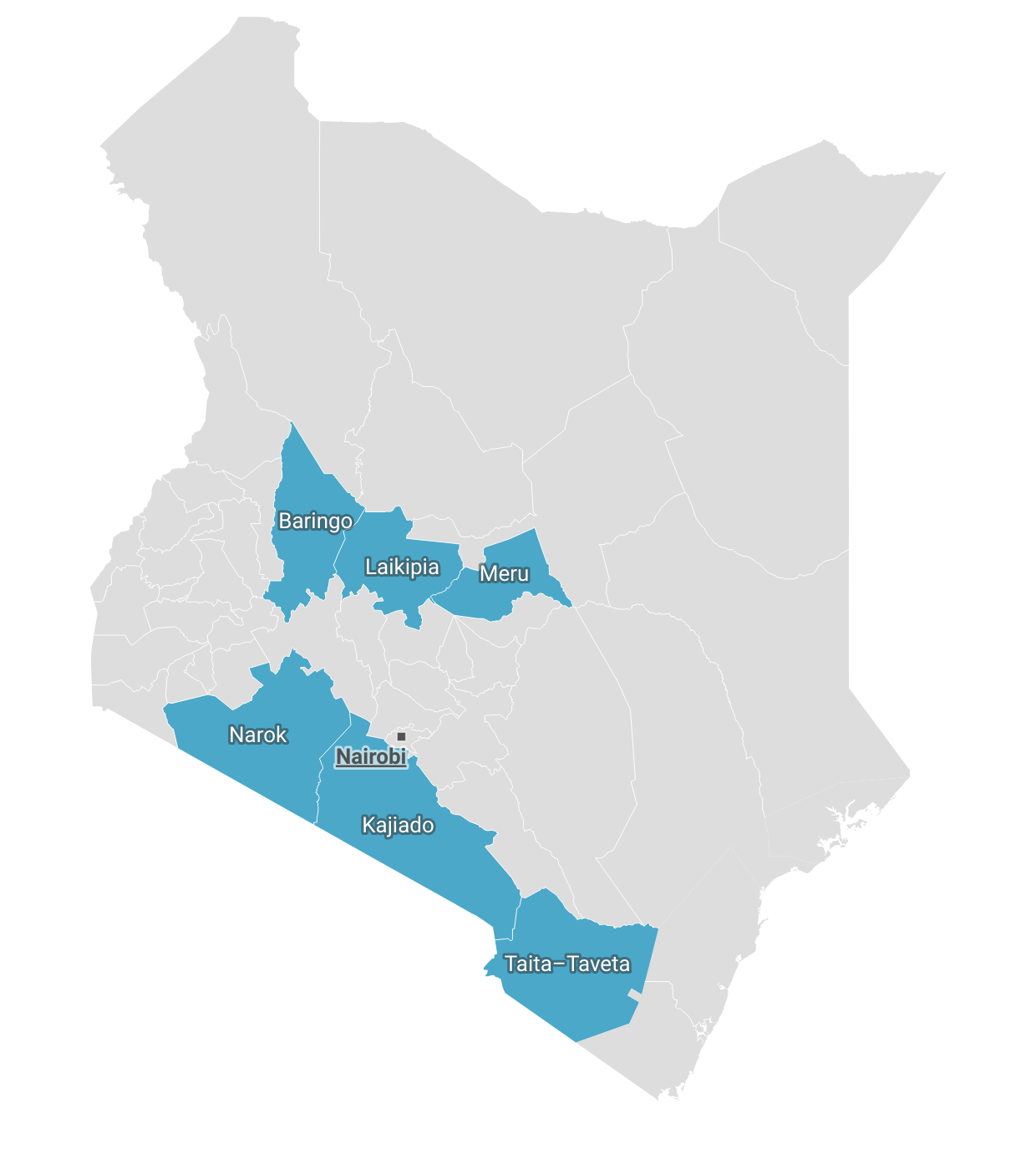

This is the first time that commercial insurance companies are involved in HWC mitigation. The scheme is designed to pay out claims for human death, human injuries, animal predation and depredation, crop damage, and property damage. Importantly, the scheme was set up as a macro sovereign insurance cover: the Government of Kenya is the policyholder on behalf of all Kenyan residents affected by wildlife outside of protected areas. As of early December 2024, the pilot was still ongoing in six counties that account for 80% of HWC incidences in Kenya (Figure 2).

Figure 2: Location of AB Entheos’ HWC pilot in Kenya – by county

Source: AB Entheos

Early results have been positive and may drive a roll-out in Kenya and beyond

The pilot covered over two million households in the six counties. By early December 2024, over 6,000 claims had been verified – around 30% of these claimants had received nearly $80,000. These numbers are expected to rise as awareness about the scheme grows and as existing target communities experience the value of the cover.

The Government of Kenya agreed to finance the premiums for the pilot to test its applicability and whether to subsequently roll out a larger national scheme to other parts of the country. Once the pilot ends in January 2026, final results will be used to determine whether this should be a viable next step. The early results have also led to interest in product development in other African countries. This scheme and appetite for it from elsewhere shows the potential for digital technology to lead to a more harmonious coexistence between humans and wildlife.