Bolstering resilience through savings-based health insurance

For those of us who are lucky enough to have good health, it can easily be taken for granted - particularly for those who live in countries with access to free universal healthcare. However, for those who don’t, any kind of illness can have a devastating long-term personal and financial impact. According to the WHO and World Bank, 1.4bn people have incurred financial hardship because of having to fund their health costs. And, as Carolina Sánchez-Páramo, Global Director of Poverty and Equity for the World Bank explains, “The disruptions to education and health care for children, coupled with catastrophic out-of-pocket health expenses...could put the brakes on the development of human capital – the levels of education, health and well-being people need to become productive members of society.” But microinsurance can provide a solution, as World Vision, VisionFund and the Swiss Capacity Building Fund (SCBF) have demonstrated through their savings-linked insurance products in Ghana and Malawi.

People who face financial precarity can be one unexpected setback away from poverty, and this has been exacerbated in recent years due to climate change and COVID-19. According to the Christian relief, development and advocacy organisation, World Vision, many people in developing countries have faced increased difficulties getting access to nutritious food, medicine and health treatments since the pandemic. They also found that many child deaths could have been avoided if they had been able to access proper health treatment. And, having to rebuild after increasingly common extreme weather events is costly, particularly for those who already struggle financially. Adding illness or injury to this can be enough to push households into poverty, particularly if they need to pay for healthcare.

Community savings groups as a pathway to insurance

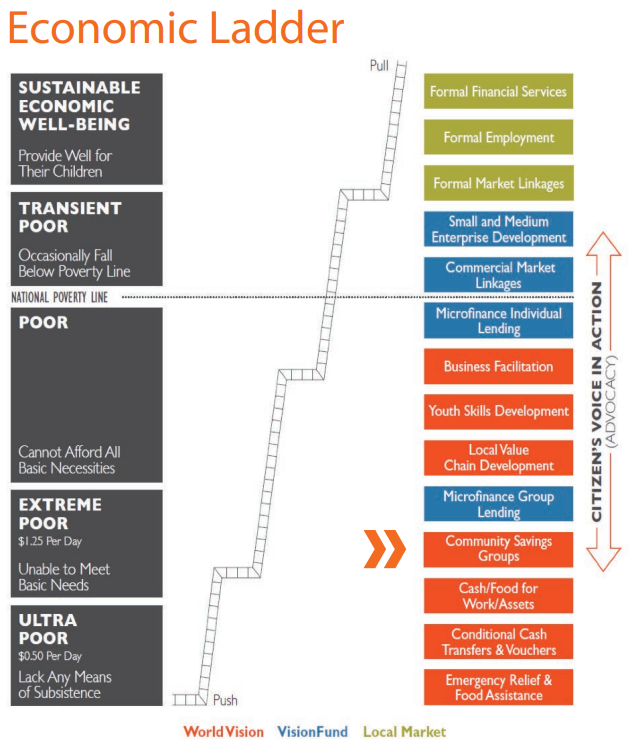

As a result, World Vision and their microfinance subsidiary, VisionFund, have been working together, with the SCBF - an innovative public-private platform that enhances inclusive finance for low-income clients in emerging contexts - to expand their microinsurance offering to those at the bottom of the economic ladder. VisionFund currently serves over 1m clients across 28 countries and in Africa alone they operate in 11 countries, lending over USD 244m to more than 569,000 clients. Until recently, insurance had only been promoted during the loan application process, where clients can either pay the premium for insurance or increase their loan amount to cover it. There are many people who could benefit from health insurance who are not currently working with VisionFund, though. They are likely to be much lower down the economic ladder with less financial education in areas such as insurance, yet many have already been enrolled into community savings groups by World Vision.

These groups were identified by VisionFund as a mechanism for the extremely poor to access insurance as a group; they can use part of their yearly share-out or part of the interest accrued to cover the cost of health insurance. For the last two years, they have piloted the provision of health microinsurance to World Vision savings groups in Ghana and Malawi through funding and support by the SCBP.

Source: Savings Linked Insurance for Resilience in Ghana and Malawi

Developing tailored microinsurance products

Simply offering a generic health microinsurance product for this group isn’t enough though; it should be developed according to their specific needs, so VisionFund developed a five-stage methodology for setting up insurance for savings groups. Stage one is a country analysis that assesses the General Economic Development indicators, Financial Sector Development (including payment systems), Insurance Sector Development, and Insurance Regulatory Framework. Stage two requires an insurance demand survey to understand the potential beneficiaries and their needs better. In stage three, a tender for product development is floated among local and regional insurance providers and facilitators, and the product is negotiated and adjusted with the selected insurer during stage four. The final stage is implementing the product.

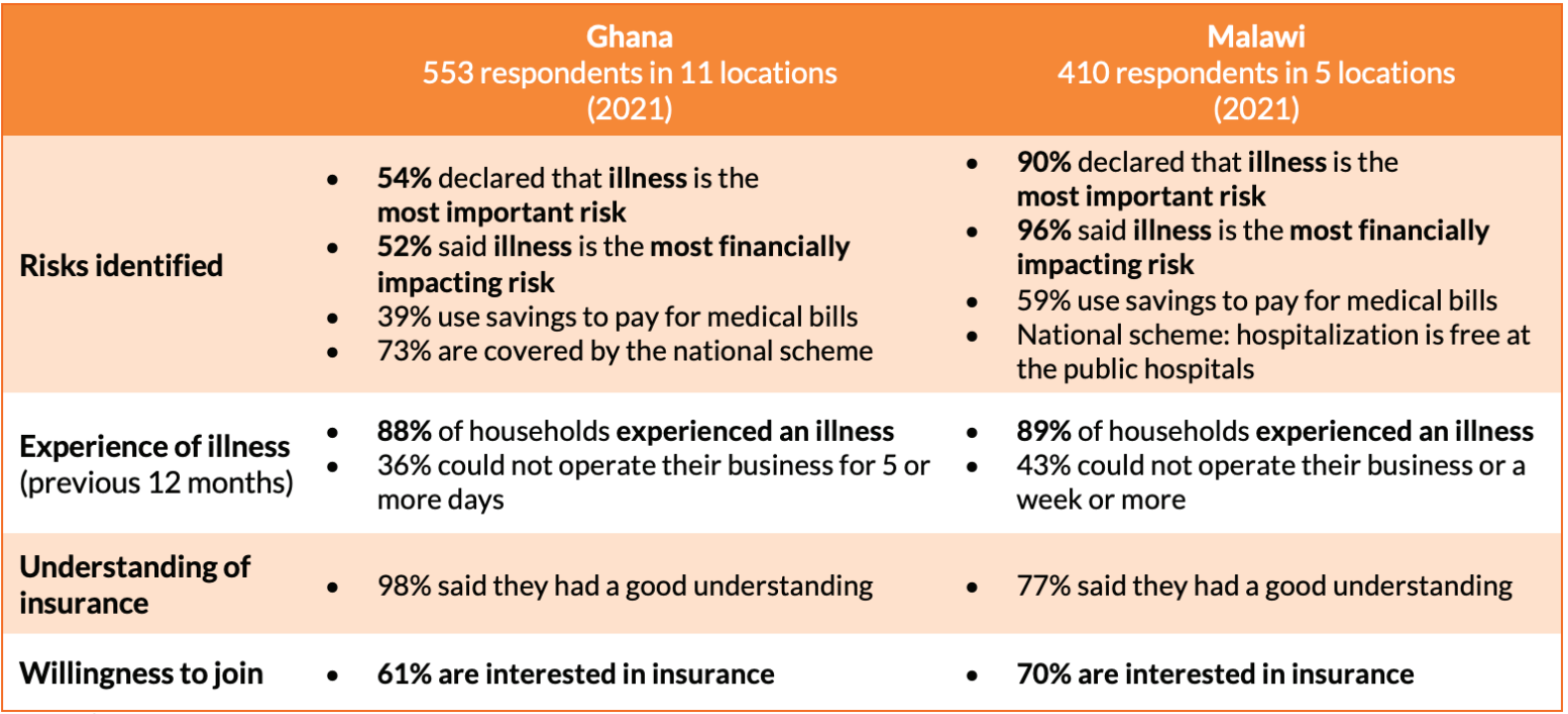

Based on this framework, VisionFund conducted a demand survey before launching the pilot in Ghana and Malawi in 2021. From this, the organisation could better assess the coping mechanisms for illness that the community used, their level of insurance knowledge and their ability and willingness to pay. The survey was completed by 553 respondents across 11 locations in Ghana and by 410 respondents across five locations in Malawi. In both countries, more than half declared that illness was the most important risk (54% in Ghana and 90% in Malawi) and the most financially-impacting risk (52% and 96%). A higher proportion of respondents in Malawi were using savings to pay for medical bills (59% vs 39% in Ghana), but all respondents had some element of access to a national health scheme. And in both countries, almost 90% of respondents had experienced an illness during the previous 12 months, of which 36% in Ghana and 43% in Malawi were unable to operate their business for more than five to seven days.

Source: Savings Linked Insurance for Resilience in Ghana and Malawi

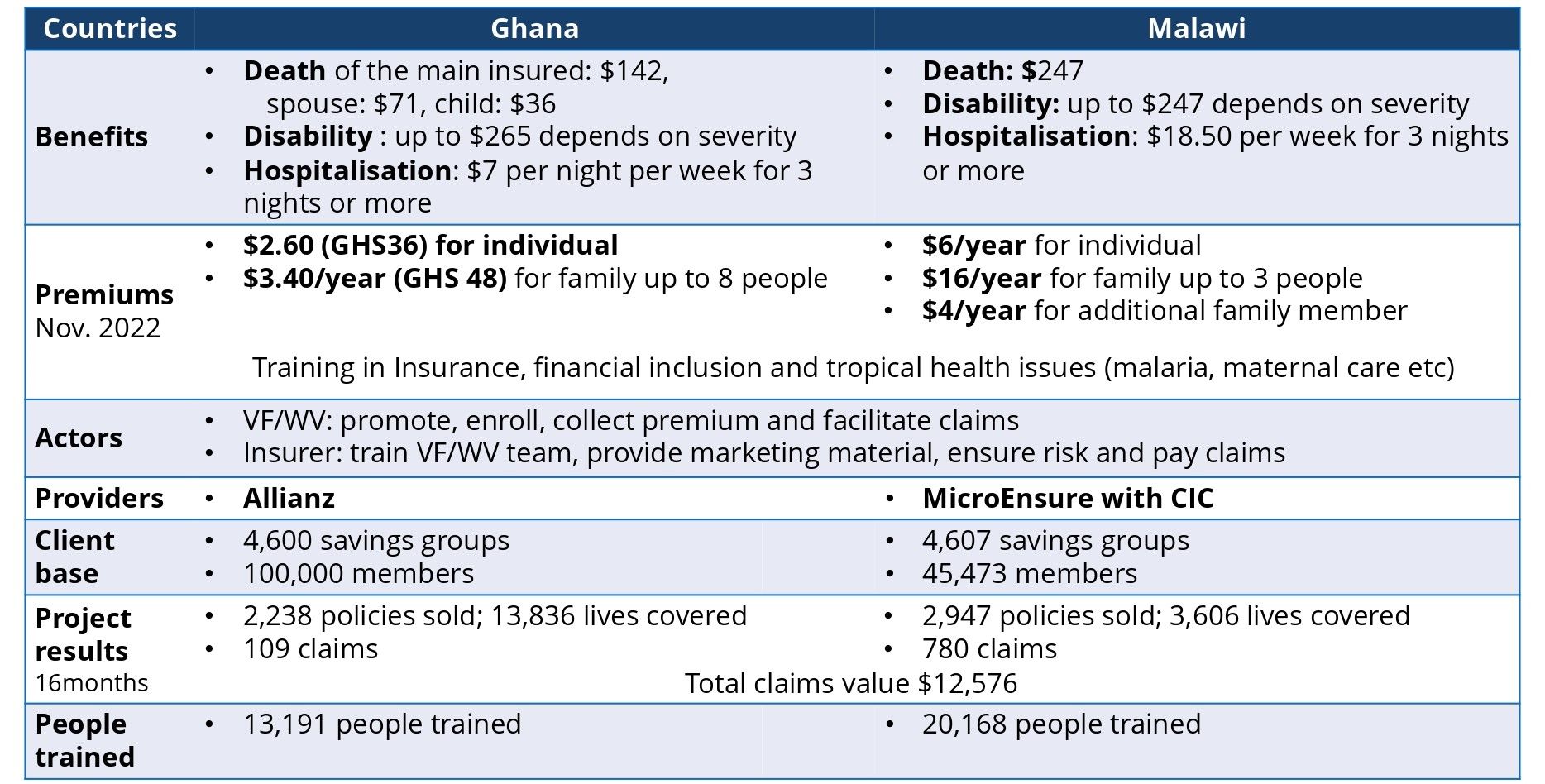

With this knowledge, VisionFund, World Vision and the SCBF were able to develop different insurance products for each market that reflected the needs of the users. In Ghana, this was a hospicash product that covered families of up to eight people for less than USD 10 annually. It included hospitalisation benefit of USD 13 per night, death benefit (USD 265 for main insured, USD 132 for spouse and USD 66 for a child) and disability benefit of up to USD 265 depending on the severity of the disability.

To come up with a similar product in Malawi required some iteration as the premium and benefits of the initial product was unbalanced, causing the insurance provider to withdraw because of a high claims ratio (225%). The final hospicash product was based on a premium of USD 6 for an individual and USD 16 for a family of up to three people with an option to add members for an extra USD 4. This covered up to USD 18.50 per week for hospitalisation for more than three nights, death benefit of USD 247 and disability benefit of up to USD 247 depending on the severity of the disability.

Source: SCBF presentation, “Savings linked insurance for resilience in Ghana and Malawi” Microinsurance Network Member Meeting, June 2023

Despite facing challenges (including difficulties remotely monitoring the field staff who sold the product, and an initial slow product uptake) the pilot delivered promising results. During the 15 months that it ran 1,924 policies covering 11,447 people were sold in Ghana with 106 claims and 2,302 policies covering 2,415 people in Malawi with 780 claims. The total value of the claims processed was USD 12,576.

Key learnings for future roll-out

Running the pilot also highlighted several learnings that VisionFund will incorporate when scaling the programme. When it came to the product itself, the pilot showed that beneficiaries preferred the family product because it is more cost effective than buying individual policies for each family member. In Ghana, where the product covers up to eight people, 94% took this option. The pilot in Malawi also highlighted the importance of designing products where the benefits and the premium are balanced, to ensure the cost is attractive to clients without making it unsustainably low for the insurer. For smooth implementation, it is also recommended to secure a product and premium for at least two years.

From a distribution perspective, the pilot showed that to achieve volume of sales it helps to bundle the product with other services, and to sell it on a mandatory or opt out basis. It also showed the need to build a good incentive scheme for the staff who distribute the insurance. One of the challenges the programme faced was that the consultants selling the product had weak reporting lines, a lack of monitoring and an unattractive fee structure. This led to low staff commitment with many engaging in other activities. Now, the programme is exploring ways to make staff more accountable and productive, including recruiting dedicated staff to monitor distributors’ activity.

Finally, the pilot showed that increased visibility of the product and its benefits through national and local promotional events, and through different forms of media (including print and local radio) helps to increase uptake of the insurance. And once someone has taken up the insurance, it is important to ensure there is regular and effective engagement between the insurer and the client, for example through welcome calls and regular SMS messages. It is also crucial that the staff have a good understanding of the insurance product they’re selling, to promote it fully and give confidence to clients around the benefits. This could be achieved through intensive training for the field teams.

The success of the pilot project that VisionFund ran with World Vision and the SCBF shows that health microinsurance can have a positive impact on poor communities and households when developed to meet the needs of each specific market. To achieve this though, it requires collaboration between the communities, insurance providers and distributors of the products. There were also several areas of improvement that resulted from the pilot. Not only will these be incorporated as the programme expands within the current markets and to new ones, including Rwanda and Uganda, but they can also be used as a guide for inclusive insurance providers to offer similar products to the communities they serve.