Agricultural microinsurance in Palestine: Building the seeds of climate resilience

Microinsurance is relatively new to the Occupied Palestinian Territory1 (hereafter referred to as Palestine): only one insurance company, Tamkeen Insurance, started offering microinsurance products for consumers in 2023. These include policies for funeral expenses, as well as family expenses, education fees and utility bills in the event of the main provider’s untimely passing (Figure 1). While this marks a significant milestone, no other microinsurance products are available for more vulnerable communities, such as small-scale farmers.

Figure 1: Details of Tamkeen Insurance’s microinsurance products

Product name | Cover description | Premium per annum | Maximum claim payout | Payout frequency |

Funeral Expenses |

Funeral expense cover for the policyholder |

$13 |

$2,650 |

Lump-sum |

My Family | Income support for a family whose main provider has passed away |

$53 |

$20,000 |

Lump-sum or annual instalments over five years.

|

My Education | Continuity of tuition payments where a family provider has passed away | |||

My Bills | Utility bill payment support where a family provider has passed away |

Source: Tamkeen Insurance website (Accessed: April 2024)

Despite falling yields and worsening risks, agriculture remains an important part of Palestine’s economy. Formally, at least 12% of the population is employed in agriculture. However, around 90% of the population is believed to be informally engaged in agriculture. Farmers in Palestine face several risks, primarily related to production, the impact of climate change and market access. Restrictions on movement and trade, limited access to natural resources, and the overall political situation have also hampered the territory’s agricultural sector. Among these risks, the impact of climate change is considered the most pressing for farmers in Palestine.

To date, farmers cope with the impact of climatic shocks and natural disasters by relying on their savings and community members’ support. Their recovery is often based on borrowing from relatives and friends, microfinance institutions or their input suppliers. This allows them to invest in part of their land to resume production cycles. Although the Palestinian government has an official compensation mechanism in place for farmers who have suffered damages, this is dependent on the government’s revenue and donor funding. Currently, the uncertain nature of the government’s resourcing means that farmer compensation can often be delayed by up to five years.

With only informal coping mechanisms and an underfunded government scheme, there is an opportunity for insurance to close the wide protection gap in Palestine. However, microinsurance is still new and there are no agricultural indemnity-based insurance products – due to the high risks involved. Oxfam in Palestine is trying to change this by encouraging partnerships to develop new agricultural insurance services for smallholder farmers. These services are likely to comprise indemnity-based products to cover medium and large-scale farmers, and index insurance to protect farmers against the impact of climate risks. When these services materialise, they are likely to be the first time that index-based insurance is used in Palestine.

“Introducing agricultural insurance could be a good start for a solidarity type of insurance between us as the farmers and our co-operatives. This is important for us to help alleviate the risk that we face in our life in this part of the world.” Anonymous Palestinian farmer’s remark to the Oxfam Palestine team |

Oxfam’s agricultural insurance project, known as “Building the Palestinian Agro-insurance System and Services” 2 is funded by the European Union. The project aims to support the agricultural insurance market through the Palestinian Agricultural Disaster Risk Reduction and Insurance Fund (PADRRIF). This is part of Oxfam’s work on climate justice, which focuses on serving smallholder farmers. The project comprises three pillars:

1. Developing an enabling regulatory framework:

While traditional insurance companies are licenced to provide insurance products, Palestine lacks a regulatory framework for agricultural insurance and microinsurance. Launching enabling regulations is hampered by the disruption of the Legislative Council, making it challenging to ratify and approve any draft regulations or amendments. To overcome this, Oxfam has embarked on a comprehensive national dialogue to ensure that all agricultural insurance stakeholders are represented (Figure 2). This will be followed by official consultations with relevant government ministries to seek approval.

Figure 2: Agricultural insurance stakeholders in Palestine

| Stakeholder | Role or responsibility |

| Farmers and producers | Intended beneficiaries representing the product demand side |

| Farmer representatives | Farmers’ and cooperative unions, responsible for safeguarding farmers and their rights |

| Ministry of Agriculture | Responsible for developing Palestine’s agricultural sector |

| Oxfam Palestine | Donor, market developer and policy advocate |

| Palestinian Agricultural Disasters Risk Reduction and Insurance Fund (PADRRIF) | Semi-governmental institution responsible for supporting farmers through disasters via insurance, compensation and investment |

| Palestine Capital Market Authority (PCMA) | Financial non-banking sector regulator, including for the insurance sector |

| Palestine Monetary Authority (PMA) | Financial banking sector regulator, including for microfinance institutions |

| Various insurance companies | Underwriting insurance products |

| Various local non-governmental organisations (NGOs) | Responsible for monitoring public policy on agricultural |

Source: Oxfam in Palestine

3. Building technical capacity:

With a lack of local expertise in agricultural insurance, the Oxfam team made use of international experts to build national capacity. This included training sessions on underwriting, policy wording, actuarial methods and loss adjustment. While helpful, this has come at a significant cost – in turn limiting the number of training cohorts who can benefit from these capacity-building sessions. Knowledge transfer from developed insurance markets remains a challenge: the project team is still aiming to embark on study visits to European, African and Mediterranean countries.

General underwriting and loss-adjustment training in Ramallah, May 2023

Source: Oxfam in Palestine

3. Country risk profiling:

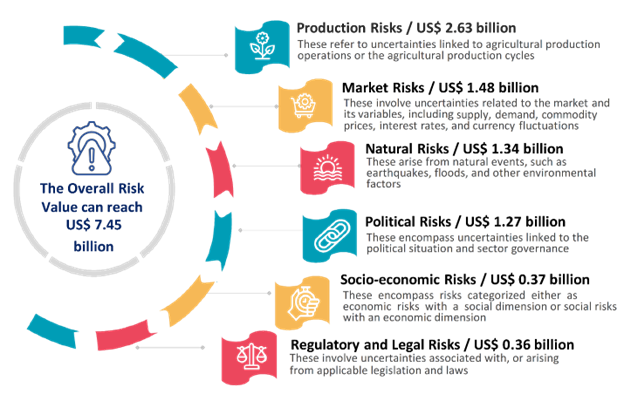

There is a lack of historical data on agricultural risks and actual damages incurred, which is necessary for any agricultural insurance product. As a result, Oxfam in Palestine invested in an agricultural market risk assessment. This assessment was nationally representative, and identified and categorised the agricultural risks that farmers face. Political, market, climate and production risks were grouped as either insurable or non-insurable, and by agricultural sub-sectors. Using this information, Oxfam developed a complete country risk profile that compared risks between the West Bank and East Jerusalem against those in the Gaza Strip (Figure 3).

Figure 3: Agricultural country risk map by risk (values are per annum)

Source: Oxfam in Palestine. Note: The risk exposure values cover one operational year and are calculated assuming that all risks can occur within a year. Normally, some parts of each type of risk occur, leading certain losses to materialise.

Oxfam in Palestine’s efforts are currently in the institution-building phase. Given the ongoing war in the Gaza Strip, activities are limited to the West Bank. However, this project marks the initial step towards creating an agricultural insurance market in Palestine. This is necessary to develop insurance as a tool to de-risk investments in the agricultural sector.

In the face of climate change challenges and political uncertainties, the introduction of microinsurance in Palestine represents a crucial step towards providing financial protection for vulnerable communities. Oxfam's initiatives, supported by the European Union, signify a promising pathway to not only to help bridge the existing protection gap but also foster resilience in Palestine's agricultural sector.

1 Please click here to understand more about the name used for Palestine in this article.

2 The “Building the Palestinian Agro-insurance System and Services” is a three-year project, funded by the EU and led by Oxfam in partnership with the Economic and Social Development Centre of Palestine (ESDC). The project aims to increase the resilience of Palestinian farmers and producers against shocks resulting from production risks, including climate change and infrastructure risks. The project aims to do this by launching an operational and sustainable agricultural insurance system through the Palestinian Agricultural Disaster Risk Reduction and Insurance Fund (PADRRIF).